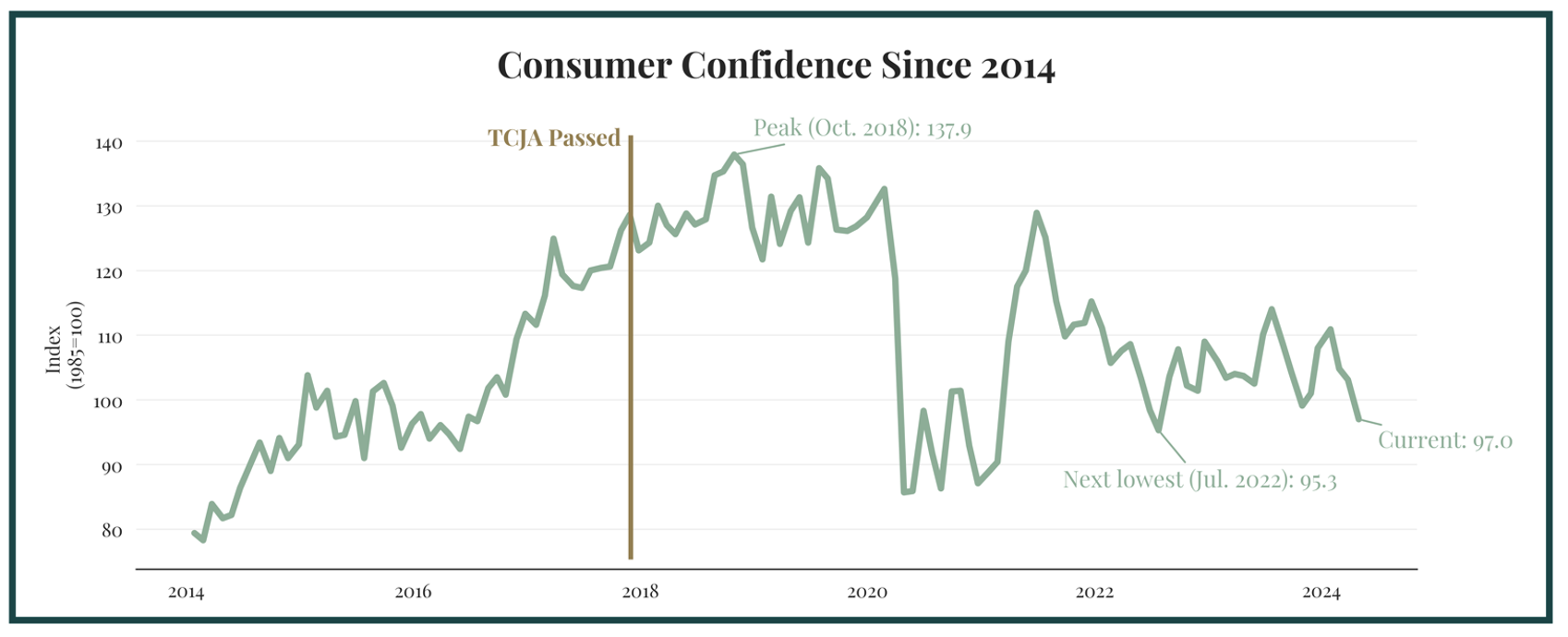

Consumer Confidence for April Falls to Lowest Level Since July 2022

WASHINGTON, D.C. – Today, The Conference Board released its report entitled, “Consumers More Pessimistic About Future Business Conditions, Jobs, and Income” on their latest report of Consumer Confidence for April 2024.

Per the Conference Board’s Consumer Confidence Survey for April, findings reflect “prevailing business conditions and likely developments for the months ahead. This monthly report details consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates. Data are available by age, income, 9 regions, and top 8 states.”

The report showed that consumer sentiment dropped dramatically by 6.1 points from 103.1 to 97, resulting in a third consecutive monthly decline. bringing it to its lowest level since July 2022 when it was 95.3. Consumer confidence has not been this low since the aftermath of Covid mandates and inflation was at its peak.

Chairman Arrington on April Consumer Confidence:

“America’s economy is waning under the massive weight of Democrats’ record borrowing and spending and the Biden administration’s push for more taxes, regulations, and government programs. It’s no surprise consumer confidence is faltering as well. In fact, we haven’t experienced this level of depression about our economic future and the attainment of the American Dream since our nation emerged from Covid mandates and shutdowns.

The ethos of the United States is that every person has the freedom and opportunity to attain a better life if they work hard - unfortunately, over the past 3 years, this has not proven to be true as our economy has slid closer to the brink of recession. Working Americans are losing nearly $1400 each month to Biden's relentless inflation, pushing the possibility of a better life further and further out of reach. The American people fear that if we don't reverse course, the greatest economy in the world will crumble and their children will not inherit the land of opportunity, but a desolate economy, a bankrupt country, and a very bleak future for their families."

What Today's Report Shows:

- In April, Consumer Confidence fell for the third consecutive month, reaching its lowest level since July 2022.

- Consumers have become more pessimistic about both the present economic situation and their near-term expectations. The expectations index continues to signal an upcoming recession.

- The index fell to 97.0 this month (April), down from 103.1 last month (March).

- This is another nonpartisan economic outlook reaffirming that consumers are still feeling the pain of high inflation and interest rates.

- Combined with last week’s GDP report, which shows just a 1.6 percent rise, this paints a negative picture of the current economic situation.

The "Why" Explained:

What is the Conference Board Consumer Confidence Index?

The Consumer Confidence Index is a tool to measure the optimism or pessimism of households about their financial situation and their ability to secure or retain employment. It is based on a level with the benchmark “100” being set to 1985.

The Conference Board’s March Report explains how they arrive at their conclusions:

“The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—increased to 151.0 (1985=100) in March from 147.6 in February.

Meanwhile, the Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell to 73.8 (1985=100), down from 76.3 last month.”

Under the Biden Administration, unbridled spending and failed economic policies have led America down a dangerous fiscal path. In March, inflation rose by 3.5%, the highest level in six months. Since President Biden took office, inflation has risen by a staggering 18.9 percent.

Our country is in a debt crisis. President Biden continues to worsen it with his unbridled spending and radical policies.

More From the House Budget Committee:

Click HERE to read Chairman Arrington’s statement on the March inflation rate coming in at 3.5 percent.

Click HERE for Chairman Arrington’s statement on GDP rising by 1.6 percent for Q1 of 2024.