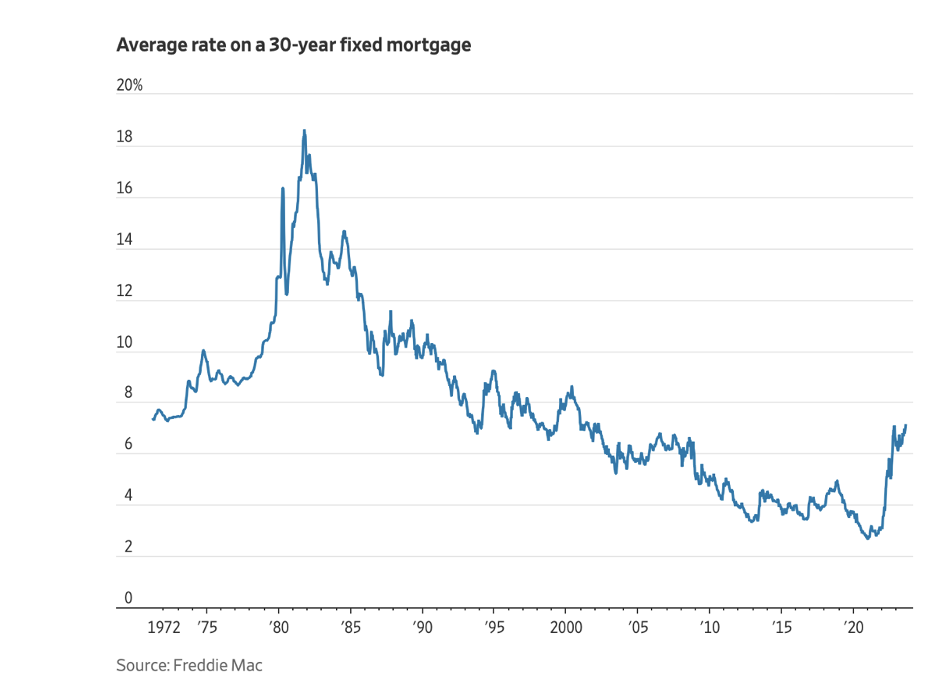

ICYMI: Mortgage Rates Hit 7.09%, Highest in More Than 20 Years

The dream of homeownership is a key tenant of the American experience. But increases in mortgage interest rates can jeopardize this American dream for millions of Americans.

When President Biden took office, mortgage rates in the United States were below 3%. Today, the average mortgage rate has increased to 7.09%, which is the highest level in almost 20 years. This recent rise is a continuation of high borrowing costs that have “slowed the housing market to a crawl," according to the Wall Street Journal.

The Details: Due to Biden’s reckless spending spree that drove record high inflation the Federal Reserve’s was forced to raise interest rates to bring down inflation. These interest rate hikes have hit the housing market hard, resulting in a drastic decrease activity in the housing market.

“Mortgage rates aren’t directly tied to the central bank’s moves. But they tend to move loosely with the 10 – year Treasury yield, which on Wednesday hit its highest level since 2008.” 10-year Treasury yields are moderately correlated to the Federal Reserves interest rate changes.

With higher interest rates expected to around longer than anticipated, many Americans are putting off the dream of home ownership, resorting to renting homes for longer than they previously foresaw.

When the Federal Reserve began increasing interest rates in 2022, the rising cost of borrowing to purchase a home was believed to be temporary. However, homebuyers are currently struggling to find anything they can afford.

The Bottom Line: Inflation caused by Biden’s failed economic policies has real world consequences for millions of Americans, making it harder for them to make ends meet and achieve the dream of homeownership.

Click here to read the full article.