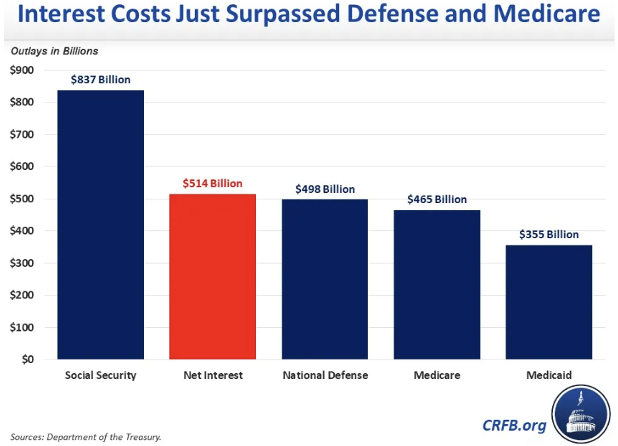

Interest Costs Surpass National Defense and Medicare Spending

Halfway into Fiscal Year 2024, and the United States is now spending more on net interest payments than on national defense and Medicare.

Last Friday, the Committee for a Responsible Federal Budget issued a piece highlighting that our Nation has spent more on net interest payments than both national defense and Medicare so far in Fiscal Year 2024.

House Budget Committee Chairman Jodey Arrington (R-TX) continues to Sound the Alarm on rising interest payments spent to finance our nation’s $34 trillion debt. Our skyrocketing interest costs are the result of Washington’s insatiable appetite for borrowing and spending, crowding out tax dollars that could be spent on important programs that Americans rely on.

Word the Street:

Via Committee for a Responsible Federal Budget:

- “Interest on the debt is currently the fastest growing part of the budget, nearly doubling from $345 billion (1.6 percent of GDP) in FY 2020 to $659 billion (2.4 percent of GDP) in 2023, and is on track to reach $870 billion (3.1 percent of GDP) by the end of FY 2024.”

- “Spending on interest is also more than all the money spent this year on veterans, education, and transportation combined.”

- “Spending on interest is now the second largest line item in the budget and is expected to remain so for the rest of the fiscal year. By 2051, interest will be the largest line item in the budget.”

- “Without reforms to reduce deficits and debt, interest costs will keep rising, continue crowding out spending on other priorities, and further burden future generations.”

The Bottom Line:

According to the Congressional Budget Office (CBO), interest payments on the national debt will nearly double under current law from $870 billion (3.1 percent of GDP) in 2024 to $1.6 trillion (3.9 percent of GDP) in 2034—the highest level in American history.

Over the next decade, net interest spending will total a staggering $12.4 trillion. By 2034, interest costs will consume over 20 percent of revenue.

As a result of the President’s economic policies, projected 10-year interest costs have almost tripled compared to when he took office.

The Committee-advanced Fiscal Year 2025 “Reverse the Curse” Budget Resolution balances the Federal budget in 10 years and reduces interest payments on the debt by $2.7 trillion—an over 20 percent reduction compared to CBO projections.