It’s Not a Revenue Problem; It’s a Spending Problem

The nation’s debt currently stands at more than $34 trillion. With about $5.79 billion in new debt incurred each day, it is blatantly clear that our fiscal house is not in order.

Unfortunately, congressional Democrats believe the only way to tackle this growing crisis is to raise taxes on American families—many of whom are struggling to get by.

Republicans and Democrats generally have two very different perspectives on how to get out of this mess. As Ronald Reagan once said, “Republicans believe every day is the Fourth of July, but the Democrats believe every day is April 15.”

But even if every day was April 15—even if Congress did raise taxes—how impactful would those revenues be toward our effort to pay down our $34 trillion federal debt?

Brian Riedl of the Manhattan Institute recently published an article in the Wall Street Journal analyzing the effect various tax and spend scenarios would have on our deficits, and the results speak for themselves.

Word on the Street Via the Wall Street Journal:

- “As budget deficits surge toward the stratosphere, Congress will soon have to get serious about savings proposals. Yet reforming Social Security and Medicare—the leading drivers of long-term deficits—remains a political nonstarter. Neither party is willing to raise middle-class taxes. And cutting defense and social spending would save at most $200 billion annually from deficits that are projected to approach $3 trillion by 2034.”

- “That leaves one option: Tax the rich. It won’t be nearly enough.”

- “Seizing every dollar of income earned over $500,000 wouldn’t balance the budget. Liquidating every dollar of billionaire wealth would fund the federal government for only nine months.”

- “America’s top tax rates often exceed international norms. Our top income-tax bracket of 43.7%—including typical state taxes—exceeds that of the standard OECD nation (40.4%). Our top capital-gains tax rate is 10 points above the OECD average, and our corporate tax rate exceeds not only the OECD mean but that of every Scandinavian nation. America’s effective corporate tax rate is also above average, as are its estate and inheritance taxes.”

The Big Picture:

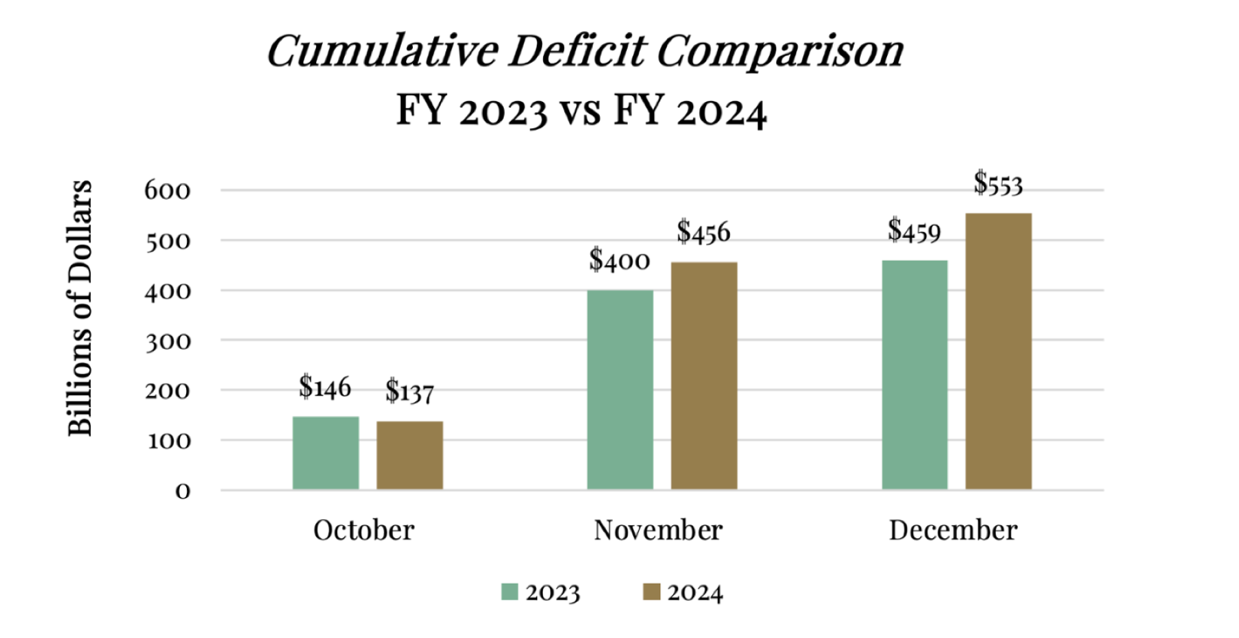

The nonpartisan Congressional Budget Office (CBO)’s latest budget review puts real life numbers behind Riedl’s report. According to their December Budget Review, deficits grew astronomically year over year—even while revenues grew too.

Revenues—income to the government from taxes—were $1.1 trillion in the first quarter of FY2024, an $83 billion, or eight percent, increase from the same time last year. But over the same period, the deficit grew by more than 20%.

The Bottom Line:

The American people deserve a clear understanding of the cause of the nation’s fiscal woes. Rather than blaming high deficits on low taxes, the numbers prove that the problem is our addiction to spending.

As Riedl puts it, “America already has the most progressive tax system in the developed world.” The last thing American families need, especially in today’s inflationary and unstable economic environment, is to be bogged down by more taxes.

The House Budget Committee is on a mission to deliver change for Americans and reverse the curse of the reckless tax-and-spend culture of Washington.