WSJ Editorial Board: States Push Back on Biden’s Student Loan ‘Forgiveness’ Schemes

Since taking office, President Biden has attempted to “cancel” more than $1 trillion worth of student loan debt – all without approval from Congress.

One of these cancellation schemes, the so-called “SAVE Plan,” was unveiled after the U.S. Supreme Court ruled the Biden Administration’s $330 billion student loan bailout as unconstitutional last summer.

Implementation of the “SAVE Plan” is now being legally challenged by 18 states.

The Wall Street Journal’s Editorial Board breaks down this latest legal challenge to Biden’s unilateral student loan actions.

Background:

President Biden’s “SAVE Plan” will result in a staggering 91 percent of new student debt becoming eligible for reduced payments and eventual transfer to taxpayers.

The Congressional Budget Office (CBO) estimates the “SAVE Plan” will cost taxpayers $260.7 billion; outside analysis by the Penn Wharton Budget Model (PWBM) projects the plan could cost up to $558 billion.

The so-called “SAVE Plan” turns the originally targeted income-driven repayment (IDR) program into a backdoor student loan cancellation scheme by:

- Reducing monthly payments from 10 percent of borrowers’ discretionary income to 5 percent of borrowers’ discretionary income.

- Reforming the “assumed amount of expenses” from 150 percent of the Federal Poverty Line to 225 percent, resulting in:

- An individual needing an income of above $32,805 before being expected to pay anything.

- A family of four needs a total income of over $67,500 in 2023 (roughly equal to the median income of all households in the U.S.) before being expected to pay anything.

- Covering the cost of unpaid monthly interest for loan payments less than the full amount, including zero payments, which prevents the loan balance from growing.

- Forgiving loan balances after 10 years of payments, instead of 20 years, for borrowers with loan balances of $12,000 or less.

Word on the Street:

- “Education Secretary Miguel Cardona recently declared that if the Administration’s new SAVE loan repayment plans weren’t challenged in court, “I’m not pushing hard enough.” Congratulations, sir. Eighteen states have now challenged this back-door loan forgiveness.”

- “The Administration rolled out the SAVE plans a mere 10 days after the Supreme Court last summer struck down Mr. Biden’s $430 billion loan forgiveness. As states argue in their lawsuits, the Education Department rushed out the plans with sloppy regulatory analysis and illegally converted loans into de facto grants.”

- “As for legal authority, the department refers to a section of the Higher Education Act that supposedly lets Mr. Cardona “craft ‘an alternate repayment plan,’ under certain circumstances.” But it omits that the law specifies that this authority is to be exercised “on a case by case basis” to “accommodate the borrower’s exceptional circumstances.”

- “The Administration is making millions of borrowers eligible for forgiveness and zero payments no matter the circumstances. Even the Obama Administration in a 2015 rule-making disclaimed the authority to relax repayment terms as Mr. Biden has done because “such a change would require congressional action.’”

- “The Education Department now says there’s no limit to how much debt it can forgive since the secretary has “discretion as to how much a borrower must pay.” Under this view, as states argue, there is nothing to prevent the secretary from limiting debt repayment to “0.01% of income over $1,000,000 for 1 year only” with the rest forgiven.”

- “Mr. Biden is playing young people for chumps by promising lower loan payments and forgiveness that may not survive in court.”

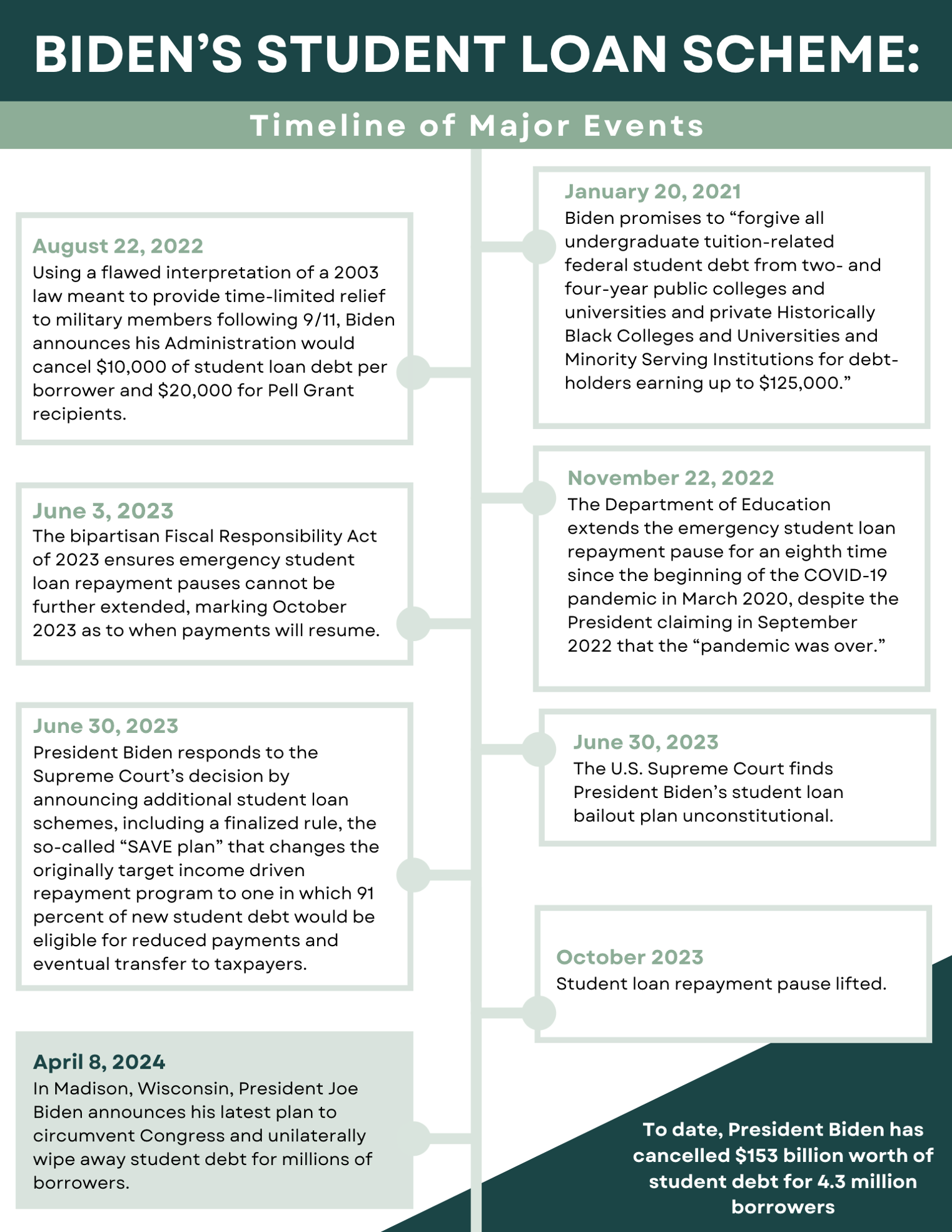

Timeline of Biden's Student Loan Scheme:

The Bottom Line:

President Biden responded to the U.S. Supreme Court by doubling down on his costly and legally questionable student loan ‘cancellation’ plans.

Just last week, the Biden Administration unveiled a brand new tranche of rules aimed at canceling student debt, which the Committee for a Responsible Federal Budget estimates could cost taxpayers up to $750 billion.

In stark contrast, the House Budget Committee’s FY 2025 “Reverse the Curse” Budget Resolution protects taxpayer dollars by ending current and future student loan bailouts.

- Click HERE to see an overview of Biden’s student loan scheme.

- Click HERE to see Chairman Arrington’s reaction to Biden’s latest student loan “Forgiveness” scheme.

- Click HERE for Chairman Arrington’s statement when President Biden announced this student loan scheme.

- Click HERE to read about Penn Wharton Budget Model’s (PWBM) analysis of President Biden’s student loan bailouts.