Applications for IRS Jobs ‘Far Below’ Agency Goals says Government Executive

In August 2022, President Biden and Congressional Democrats rushed to enact their reckless tax and spending spree, the so-called Inflation Reduction Act (IRA), into law.

One of the more problematic provisions included in the IRA allocated $80 billion dollars in taxpayer dollars to the Internal Revenue Service (IRS) in hopes of supercharging the volume of financial audits imposed on lower and middle-income Americans and small businesses.

A recent report from the Treasury Inspector General for Tax Administration (TIGTA) reveals that despite this surplus in funding, the IRS has failed to fulfill its own exorbitant hiring initiative – leaving tens of billions of taxpayer dollars in limbo.

Word on the Street:

Via Government Executive:

- “A new report from the Treasury Inspector General from Tax Administration on the initial implementation of the IRA found that the IRS is failing to bring on its first wave of specialists.”

- “IRS had planned to bring on 3,833 revenue agents in fiscal 2023, but in the first six months officials had recruited just 34.”

- “‘External applications that have been received are far below the IRS targeted goal and there is an overall shortage of individuals with the desired background and experience,’ TIGTA found.”

- “A previous IG report found that despite its new funding, revenue agent staffing had actually decreased by 8%, or more than 650 employees, between the end of fiscal 2019 and March 2023.”

- “Erin Collins, the National Taxpayer Advocate, warned in a recent report that the IRS Human Capital Office ‘lacks the necessary resource investments,’ including IT and staffing, to keep up with the agency’s new hiring demands.”

- “If the IRS does not make significant changes, these staffing shortages will compound and pose significant threats to federal tax administration and taxpayer rights.”

The Bottom Line:

Democrats’ partisan passage of the IRA fueled the consequences of their radical, inflationary legislative agenda by prioritizing the expansion of an already bloated federal bureaucracy, while leaving the American consumer to fend for themselves.

The IRA’s IRS expansion was originally billed as “enhanced enforcement” to raise revenue for their (now-debunked) deficit neutral proposal by hiring 87, 000 new IRS agents to target those individuals and small businesses least able to afford it.

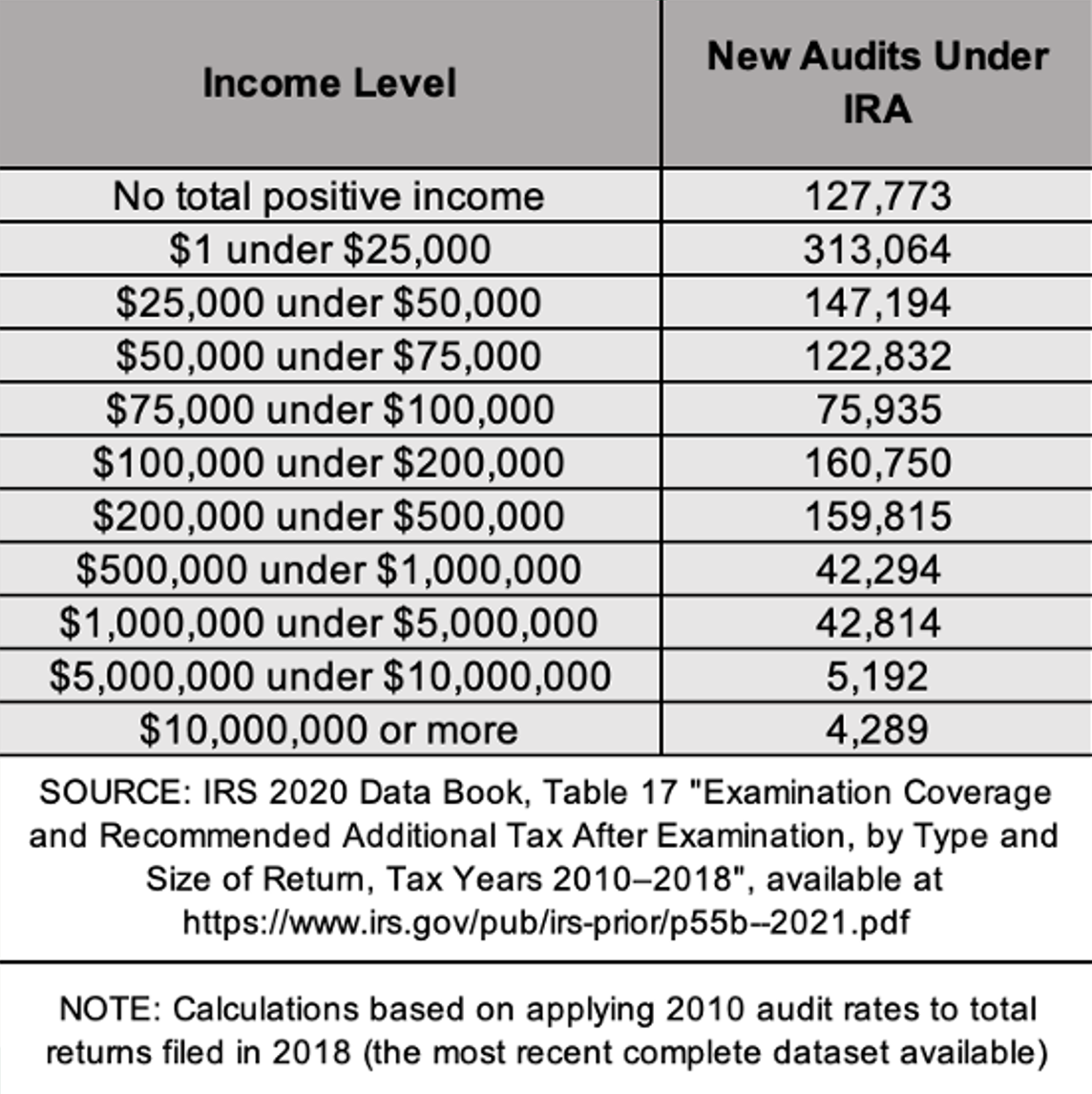

According to the Joint Committee on Taxation (JCT), Congress’s official tax scorekeeper, 78 percent to 90 percent of the revenue raised from “under-reported income” would likely be born from Americans making less than $200,000 a year, while only 4 percent to 9 percent of anticipated revenue would be raised from those making more than $500,000 a year:

Even worse, more than half of the intended audits would hit Americans making $75,000 per year or less. And despite the significant need for improved taxpayer customer service amidst a historic, prolonged tax return backlog, only $3.2 billion of Democrats’ $80 billion is earmarked for that purpose.

Nearly 2 years later and the IRS’ plan to execute “enhanced enforcement” has significantly underperformed Democrats' intended expectations.

According to a recent study from the Economic Policy Innovation Center (EPIC), rather than raising the once-anticipated $2.9 billion for fiscal year 2023, only $160 million was collected from the Democrat’s supercharged IRA expansion. Further, projected revenue raised for 2024 totaled $7.8 billion yet has yielded just $360 million in the first quarter.

The best way to ensure tax compliance is to simplify the tax code, not supercharge a well-documented predatory surveillance bureaucracy on the backs of hard-working Americans.

The House Budget Committee’s “Reverse the Curse” Budget Resolution for FY25 through FY34 balances the federal budget in 10 years by halting the invasive financial audits imposed on American families in favor of pro-growth tax policy that will increase desperately needed federal revenue.