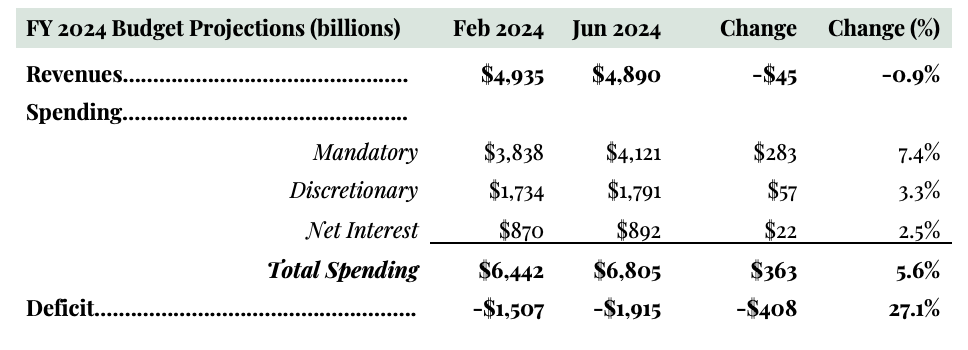

Congressional Budget Office Updates Baseline: Deficit Spending is 27 Percent Higher Than Previously Estimated

WASHINGTON, D.C. – Today, the Congressional Budget Office (CBO) released its updated budget projections for fiscal years (FY) 2024-2034. This is an update to its February baseline. CBO’s report helps Congress understand the fiscal and economic challenges facing the country.

House Budget Committee Chairman Jodey Arrington (R-TX) released the following statement on CBO’s updated baseline:

“CBO’s June revised baseline could be the final budget outlook of fiscal year 2024 and its findings are more dire than previously expected - meaning, today’s baseline could be our final wakeup call of the 118th Congress to take stock of the fiscal state of our nation after four years of failed economic policies by the Biden Administration.

CBO now projects that deficit spending for FY24 will reach a staggering $1.9 trillion, an estimate that is $400 billion higher than CBO predicted just four months earlier. This 4-month, $400 billion increase in projected deficits marks the third highest yearly deficit increase in American history, equal to 6.7 percent of our GDP. A primary driver of this increase is President Biden’s record 138 executive actions issued over the past three years and five months, costing more than $2 trillion. Making matters worse, CBO finds that the total cost of interest payments on our nation’s debt have increased by $540 billion, or 153 percent since President Biden took office.

Unfortunately, revenues collected by the Treasury continue to be swallowed up by massive federal spending, racking up more debt, eroding consumer confidence, and fueling the persistent cost of living crisis borne by working families.

As bleak as CBO’s fiscal outlook is, CBO does not currently account for one of the most significant strains on the U.S. economy: the cost of President Biden’s wide-open southern border. Absent from CBO’s June 2024 baseline is the significant, adverse financial impact that illegal immigration has created at the state and local level, as well as the unwelcome increase to discretionary spending programs (including, law enforcement, grants, welfare, education, homeland security, etc.) as well as long-term retirement costs.

To stop runaway inflation and safeguard the future economic security of our nation’s children, Congress must reverse the spending curse of the Biden Administration by undoing expensive and overreaching executive actions, addressing the most significant debt drivers of health care and welfare spending, rooting out federal waste, and reining-in the weaponized and bloated federal bureaucracy.”

Topline Takeaway's from CBO's Baseline Update:

-

CBO now projects that deficit spending for FY24 will reach a staggering $1.9 trillion, an estimate that is $400 billion higher than CBO predicted just four months earlier. This is the third highest yearly deficit increase in American history.

a. A key driver is the Biden Administration’s use of executive actions. 138 executive actions have been issued over the past three years and five months, costing more than $2 trillion. More than a third of the increased projection by CBO is a direct result of President Biden’s unilateral cancelation of student loans earlier this year.

2. The FY 2024 deficit is equivalent to 6.7 percent of GDP (the 50-year average is 3.7 percent), which is the highest peacetime figure in American history outside of the 2008 financial crisis and the COVID-19 Pandemic.

a. This historically high projection coincides with a 17.2 percent of GDP revenue projection (roughly equal to 50-year average of 17.3 percent). Higher spending, 23.9 percent of GDP compared to 50-year average of 21.0 percent, is primarily to blame.

3. Interest spending has increased by $540 billion. or 153 percent in the three years since President Biden took office.

a. Interest costs are projected to increase from 9 percent of federal revenue in 2021 to 18 percent of federal revenue in 2024 to 23 percent of federal revenue in 2034.

4. CBO’s estimates do not currently fully account for the cost of President Biden’s wide-open southern border, as they do not capture the expenditures associated with illegal immigration at the state and local level.

a. The fiscal impact on state and local governments and communities should include the cost of localized crime and law enforcement, along with the state-based costs for housing, clothing, education, and providing health services for immigrants and their dependents.

5. Our country has a spending problem.

a. Revenues collected by the Treasury continue to exceed expectations. FY 2024 revenues are now projected to be $4.9 trillion, which is $538 billion or 12 percent higher than CBO expected when Biden took office and represents an increase of $1.5 trillion or 43 percent in just four years.

b. At the same time, unsustainable federal and executive spending have skyrocketed, counteracting the benefits of incoming revenues by undermining the prowess of the U.S. economy. Federal spending is $1.5 trillion or 29 percent higher than CBO projected it would be when Biden took office, causing the projected FY 2024 deficit to be $1 trillion or 112 percent higher than CBO anticipated when President Biden took office.

More on CBO's Updated Baseline:

CBO released its updated budget projections for fiscal years (FY) 2024-2034. CBO’s annual report helps Congress understand the fiscal and economic challenges facing the country. According to the report:

-

Gross Federal Debt totals $56.8 trillion (137.3 percent of GDP) in 2034, up from $34.7 trillion (122.7 percent of GDP) now.

-

FY2024 Deficit totals $1.9 trillion, the third highest figure in American history. The FY 2024 deficit is equivalent to 6.7 percent of GDP (the 50-year average is 3.7 percent).

-

Ten Year Deficit totals $22.1 trillion. The deficit increases by 49 percent over the budget window, growing from $1.9 trillion this year to $2.9 trillion (6.9 percent of GDP) in 2034.

-

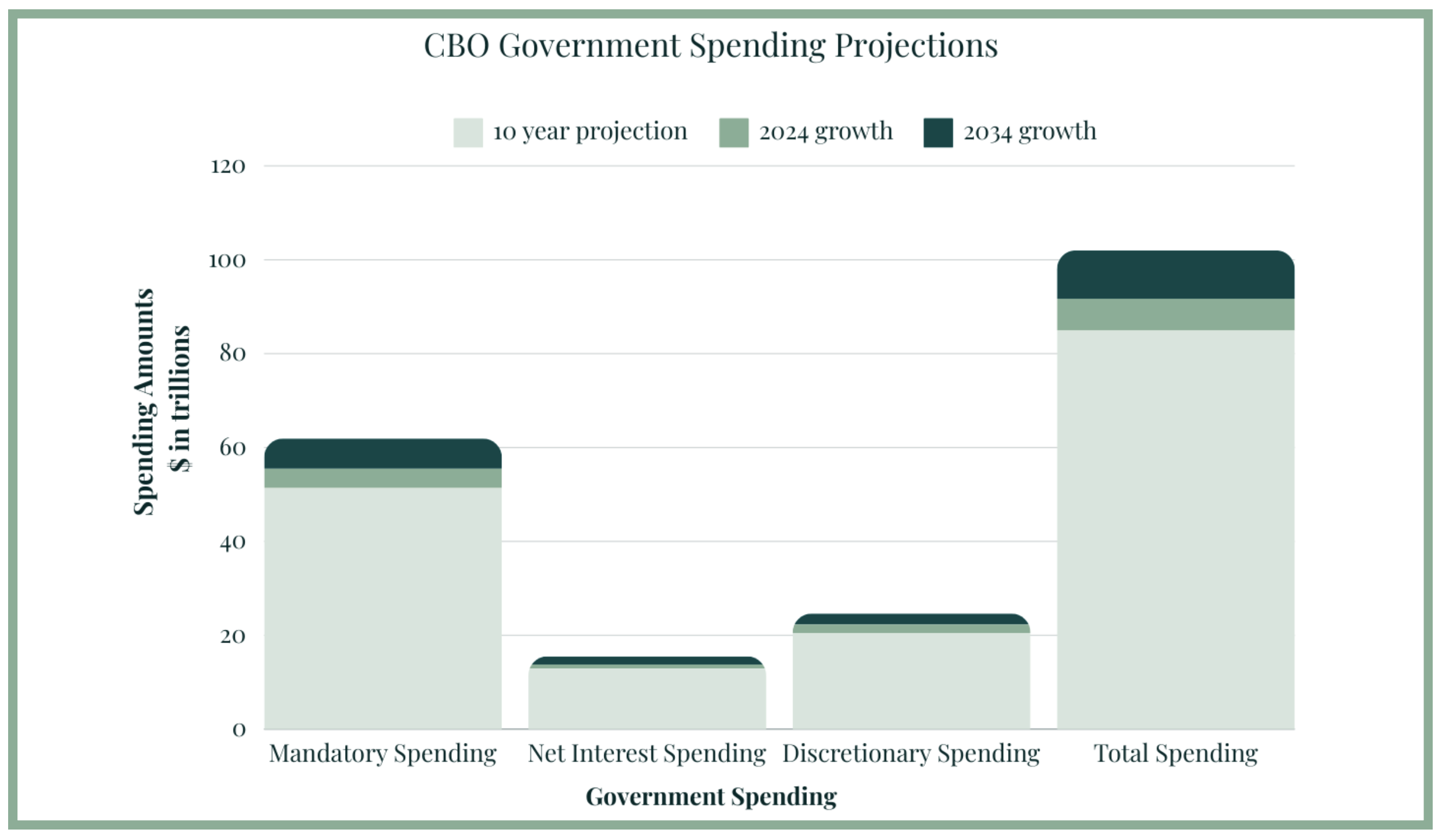

Spending totals $84.9 trillion over ten years, and grows from $6.8 trillion(23.9 percent of GDP) in 2024 to $10.3 trillion(24.9 percent of GDP) in 2034. CBO projects mandatory spending (including interest) will increase from 74 percent of the budget in 2024 to 78 percent of the budget in 2034.

-

Mandatory Spending: $51.4 trillion over ten years, grows from $4.1 trillion (14.5 percent of GDP) in 2024 to $6.4 trillion (15.3 percent of GDP) in 2034.

-

Net Interest Spending: $12.9 trillion over ten years, grows from $892 billion (3.1 percent of GDP) in 2024 to $1.7 trillion (4.1 percent of GDP) in 2034.

- Discretionary Spending: $20.5 trillion over ten years, grows from $1.8 trillion (6.3 percent of GDP) in 2024 to $2.3 trillion (5.5. percent of GDP) in 2034.

- Revenue totals $62.8 trillion over ten years, and grows from $4.9 trillion (17.2 percent of GDP) in 2024 to $7.5 trillion (18.0 percent of GDP) in 2034. Revenue averages 17.8 percent of GDP over the decade, above the 50-year average of 17.3 percent of GDP.

- Economic Growth measures at 2.0 percent in 2024, with a paltry 1.8 percent annual average over the next decade.

- CPI inflation measures at 3.0 percent in 2024, with a 2.3 percent annual average over the next decade.

- The projected interest rate on 10-year Treasury notes for 2024 has increased from 1.5 percent when President Biden took office to 4.5 percent in CBO’s latest projection. The 10-year average interest rate projection is 3.0 percent.

What's Missing:

CBO’s calculations on the fiscal impact of the border crisis focus on spending at the federal level but do not capture the expenditures associated with illegal immigration at the state and local levels, do not include discretionary costs, and do not include long-term entitlement costs.

The skyrocketing fiscal consequence that illegal immigration imposes at the state and local level, as well as the unwelcome increase to discretionary spending programs (including, law enforcement, grants, welfare, education, homeland security, etc.) and long-term retirement costs must be included to get the full cost of the crisis.

More from the House Budget Committee:

Read an executive summary of CBO’s updated budget projections for fiscal years (FY) 2024-2034 HERE.

Read comparisons of CBO’s February 2024 baseline report and the June 2024 update, and a comparison of the baseline when President Biden took office to today HERE.

Find a comparison graphic of the February 2024 to June 2024 baseline HERE.

Find a report card of Biden’s Four Years of Fiscal Failure HERE.