FACT CHECK ALERT: Debunking CRFB’s Analysis of Trump and Biden Impacts on the National Debt

WASHINGTON, D.C. – This week, the Committee for a Responsible Federal Budget (CRFB) released a report entitled, “Trump and Biden: The National Debt.”

The CRFB’s report attempts to compare the fiscal impact of the policies of the current Administration with the policies of the previous Administration, yet fails to accurately capture the total cost incurred by both presidencies.

The CRFB’s report:

- Ignores the track record of increasing revenues following passage of TCJA;

- Omits the full cost of legislative actions per CBO data;

- Fails to account for inflation-induced interest rate hikes increasing projected net interest costs by $4.8 trillion over ten years under President Biden; and

- Undercounts the costs of President Biden’s executive actions by more than $800 billion.

The CRFB states the Biden Administration increased the federal deficit by just $4.3 trillion. In reality, the Biden Administration has increased the federal deficit by $11.6 trillion dollars throughout the last three years and six months, including:

- $4.8 trillion in enacted legislation;

- $4.8 trillion in higher interest costs; and,

- $2 trillion by executive actions

What CRFB Got Wrong on President Biden:

CLAIM: President Biden’s executive actions have added just $1.2 trillion to ten-year debt.

FACT: Since taking office, President Biden has proposed and implemented executive actions that have cost taxpayers over $2 trillion.

A list of the Biden Administration’s costly executive actions includes:

- Ending Medicaid Work Requirements

When: January 2021

Cost: $3 billion

Action: Implemented an executive order that empowered the Centers for Medicare & Medicaid Services (CMS) to revoke state Medicaid waivers that allowed states to implement work requirements. -

Thrifty Food Plan Overhaul

When: August 2021

Cost: $300 Billion

Action: Overhauls the Thrifty Food Plan—the formula that determines Supplemental Nutrition Assistance Program (SNAP) benefits—increasing SNAP benefits by 23 percent, breaking partisan precedent and violating the Congressional Review Act of 1996 in the process. -

Government Contractor Rule

When: November 2021

Cost: $3 Billion

Action: Requires federal contractors to pay their employees $15 per hour beginning in 2022, indexed to inflation for every year thereafter, increasing the cost of federal contracts at the taxpayer's expense. - New Public Charge Rule

When: September 2022

Cost: $26 billion*

Action: Reversed President Trump's common-sense public charge rule by explicitly excluding some welfare programs from public charge determinations. - Illegal Obamacare Expansion

When: October 2022

Cost: $34 billion

Action: Rewrites a provision in the Affordable Care Act to transition over 600,000 Americans already enrolled in employer coverage onto Obamacare. The Biden Administration's rule ran afoul of the statutory text, clear Congressional intent, and the Obama Administration's interpretation of the law. - Student Loan Repayment Pause

When: November 2022 (last extension)

Cost: $165 billion

Action: Extended the COVID-19 pandemic student loan repayment pause an unwarranted six times, even after the President himself declared the "pandemic was over," despite bipartisan concerns that the pause worsens inflation. - So-Called "SAVE Plan"

When: June 2023

Cost: $260 billion

Action: Turned the originally targeted income-driven repayment (IDR) program into one massive iteration in which 91 percent of new student debt would be eligible to receive reduced payment and eventual transfer to taxpayers. - Medicaid Eligibility Rule

When: September 2023 and March 2024

Cost: $164 billion*

Action: Weakens Medicaid eligibility standards by limiting the time between eligibility reevaluations and eliminating the requirement for in-person interviews for some populations, threatening to further increase improper and fraudulent payments in the Medicaid program. - New Student Loan Bailout Scheme

When: April 2024

Cost: $132 billion

Action: Proposed four new provisions to cancel student loan debt, one of which makes "about 750,000 households making over $312,000 in average household income" eligible for loan cancellation, according to the Penn Wharton Budget Model analysis. - Nursing Home Minimum Staffing Rule

When: April 2024

Cost: $22 billion

Action: Established a one-size-fits-all minimum staffing requirement and standards for nursing homes which independent analysis estimates over 80 percent of nursing homes would not be able to comply with. This proposal would endanger access to care in rural and underserved areas and increase federal spending. - New Multi-Pollutant Emission Standards for Light- and Medium-Duty Vehicles

When: March 2024

Cost: $224 billion

Action: Set irrationally high standards to reduce greenhouse gas emissions, forcing automobile manufacturers to transition 70 percent of their fleets to electric by 2030. - "Hardship" Student Loan Proposal

When: Upcoming

Cost: $350 billion

Action: The upcoming rule that would forgive student debt based on "financial hardship;" is projected to cost anywhere from $100 billion to $600 billion, according to the CRFB. - Ending Trump-era SNAP Work Requirements

When: Throughout tenure

Cost: $11 billion

Action: In December 2019, the Trump Administration attempted to address the abuse of geographic waiver loopholes, which have allowed millions of able-bodied adults to receive SNAP benefits without working, by submitting a final rule that imposed stricter standards for states to issue waivers. However, the rule was held up in the courts and never fully went into effect. - Additional Net Interest Payments

Cost: $300 billion

Details: Federal spending contributes to our national debt and thus raises the net interest payments the federal government must make on the debt. - DACA Obamacare Eligibility

When: May 2024

Cost: $7 billion

Action: Extends eligibility for taxpayer-funded Obamacare premium tax credits to Deferred Action for Childhood Arrivals (DACA) recipients.

* Source: The Congressional Budget Office (CBO)

CLAIM: The American Rescue Plan Act was a COVID relief package.

FACT: While CRFB accurately includes the American Rescue Plan (ARP) Act of 2021 on President Biden’s ledger, elsewhere in the report it inaccurately portrays the entire ARP as COVID legislation. The COVID-19 relief laws enacted in 2020 and 2021 provided more than $5 trillion in funding for pandemic response and recovery. Four of these COVID relief packages were advanced by nearly unanimous, bipartisan and bicameral support under the leadership of President Trump. In contrast, the ARP was adopted by President Biden and Congressional Democrats by an entirely partisan vote.

Further, of the new spending generated by the ARP, $1.7 trillion of that funding was not directly devoted to combatting the public health pressures COVID-19 pandemic.

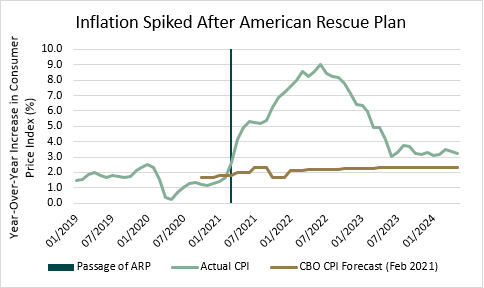

According to a previous CRFB statement: “Only about 1 percent of the entire package goes toward COVID vaccines, and 5 percent is truly focused on public health needs surrounding the pandemic.” Instead, this unprecedented spending was added to an already rapidly growing economy, which predictably fueled the highest spike in consumer prices in 40 years.

CLAIM: President Biden’s legislative actions have added $3 trillion to the debt.

FACT: According to CBO, President Biden’s enacted legislation increased deficit projections by a total of $4.8 trillion over ten years.

The CRFB analysis errs in several respects:

- By not using CBO data on the impact of legislative actions on projected deficits. According to CBO data, derived from their budget and economic outlook updates, deficit projections increased by a cumulative total of $5.9 trillion from legislative actions taken by Biden and a Democratic Congress.

- By significantly underestimating the cost of the Inflation Reduction Act (IRA): The CRFB attributes savings of $252 billion to the IRA. However, the original score of the bill understated the cost of green energy tax provisions by at least $500 billion over ten years. Further, this figure includes $122 billion of savings from delaying a Medicare drug rebate rule that was never going to take effect. Further, the CRFB counts $180 billion of higher tax collections from higher IRS funding, but these savings are non-scoreable by scorekeeping guidelines.

- By significantly underestimating the cost of the Bipartisan Infrastructure Law: The CRFB analysis doesn’t include the $1.1 trillion of projected higher discretionary spending accruing from the law.

The CRFB analysis lacks important context:

- By giving President Biden credit for the Fiscal Responsibility Act without context: The CRFB credits President Biden alone for $1.5 trillion of savings for signing the Fiscal Responsibility Act into law. As a reminder, President Biden was opposed to making any deal on a debt ceiling increase and only agreed to spending reforms because the House forced his hand. It's important to understand that Republicans in the House had a major role in getting this across the finish line. While CRFB gives Biden full credit for the $1.5 trillion in savings, it never would have come to pass if House Republicans hadn't demanded it.

CLAIM: The $4.3 trillion of deficit spending under President Biden includes interest costs.

FACT: Since the enactment of the American Rescue Plan (ARP) Act of 2021, signed into law on March 11, 2021, President Biden has overseen 11 interest rate hikes to combat the 40-year spike in inflation that directly resulted from the influx of funding introduced into the U.S. marketplace by the ARP:

According to CBO, since Biden took office, inflation-induced interest rate hikes have increased projected net interest costs by $4.8 trillion over ten years. Even though this cost is attributable to Biden’s economic policies, it is not included in the CRFB’s calculations. Interest spending has increased by $540 billion, or 153 percent, in the three years since President Biden took office. Interest payments on the federal debt total $892 billion (3.1 percent of GDP) and are now projected to become the second largest item in the federal budget this year, exceeding spending on both national defense and Medicare.

Interest costs are projected to increase further from 9 percent of federal revenue in 2021 to 18 percent of federal revenue in 2024 to 23 percent of federal revenue in 2034. Each dollar spent on servicing our national debt is a dollar wasted.

As the U.S. federal government continues its habit of out-of-control spending, taxpayer funds are needlessly redirected from funding for key legislative priorities, such as critical infrastructure, education, and health care.

What CRFB Got Wrong on President Trump:

CLAIM: The Tax Cuts and Jobs Act increased the federal debt by $1.9 trillion.

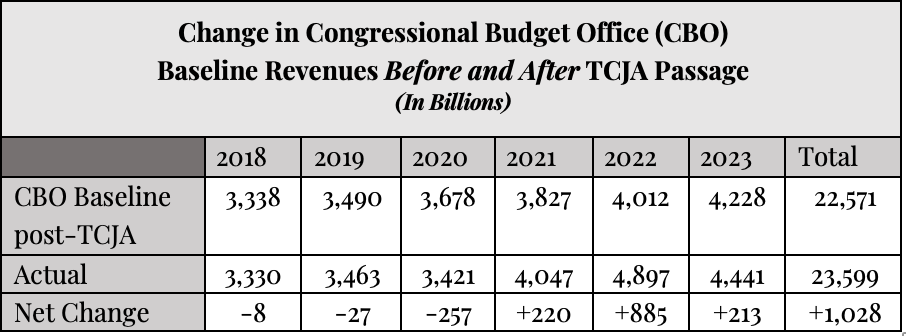

FACT: In the first six years after enactment of the Tax Cuts and Jobs Act, the increase in federal revenues accounted for more than $1 trillion dollars higher than originally projected. Even after adjusting for inflation, revenue remains $600 billion higher than projected in the first six years of implementation.

CLAIM: Ending federal appropriations for the Affordable Care Act (ACA) cost-sharing reduction payments in 2017 led insurers to raise premiums on “silver” ACA plans, ultimately increasing the cost of federal subsidies by an estimated $220 billion.

FACT: Premiums for ACA plans have risen significantly since the passage of the ACA, prior to President Trump even entering office. The increasing cost of premiums resulted from the law imposing federal mandates and a subsidy structure that grows dollar-for-dollar with premiums, providing health insurance companies with increased pricing power.

CLAIM: A 2020 rule to restrict prescription drug rebates paid to pharmacy benefit managers (PBMs) and insurance plans was estimated to cost the federal government $177 billion dollars. Ensuing interest costs were estimated to add an additional $59 billion more to the federal deficit.

FACT: Even though the CRFB admits this rule was delayed and ultimately repealed under President Biden, the CRFB still includes this assumption in its analysis of costs borne by the Trump presidency. This is misleading. The purported costs never came into effect. And it is inconsistent with CRFB’s methodology in not counting Biden's student loan executive actions that did not take effect.

The Bottom Line:

The American public deserves transparency and accuracy when it comes to our national debt. The CRFB’s analysis significantly underestimates the contribution to the national debt from President Biden’s policies and inflates the fiscal impact of President Trump’s policies.

By not incorporating the true cost of legislative and executive actions, as well as failing to account for the broader economic consequences (higher interest rates and inflation) of President Biden's policies, the CRFB report is incomplete and inaccurate.