FACT CHECK: Setting the Record Straight on Bidenomics

This week, the White House circulated a slide deck to Hill Democrats riddled with inaccuracies, false statements, and misleading information about Biden’s record on the economy. Let’s set the record straight.

BIDEN CLAIM: “President Biden and Congressional Democrats’ plan to grow the economy from the bottom up and middle out, not the top down, is delivering for the American people. President Biden and Congressional Democrats have worked together to grow the economy and create a record number of jobs.” The President says that his Administration has: “Created more than 13 million jobs; brought the unemployment rate below 4 percent four years before experts projected and kept it there for the longest period in more than 50 years; and achieved record low unemployment rates for African Americans, Hispanics, people with disabilities – and the lowest unemployment rate in 70 years for women.”

FACT CHECK: Recovery Versus Creation

- Nearly 72 percent of all job gains since 2021 were simply jobs that were being recovered from the pandemic, not new job creation. In fact, when looking at today’s economy compared to pre-pandemic levels, employment is up only by 3.7 million, not 13 million.

- On the other hand, in his first 2.5 years, job creation under President Trump was 5 million—1.3 million more jobs than the current President in the same time frame after factoring in the recovery from pandemic.

.png)

BIDEN CLAIM: “(President Biden) proved that a strong recovery and support for households brings more people into the workforce: a higher share of working age Americans are in the workforce now than at any time in more than 20 years and higher than on any day of the prior Administration.”

FACT CHECK: Labor force participation was stronger under President Trump.

- The labor force participation rate remains 0.7 percentage points lower under Biden than it was when President Trump was in office.

- When adjusting for population gains, nearly 2 million more Americans are on the sidelines today than they were during the previous Administration.

BIDEN CLAIM: Under President Biden, American families are “better off than before the pandemic: Americans have more net worth and higher inflation-adjusted disposable incomes and a lower uninsured rate.”

FACT CHECK: Wages are NOT keeping up with Biden’s inflation crisis.

- Real wages are down over 5 percent since President Biden entered the Oval Office.

- Since President Biden took office, the average worker has lost over $4,900 in real wages.

BIDEN CLAIM: The White House is “working to bring down the cost of living, including by lowering drug prices. Inflation has come down 11 months in a row.”

FACT CHECK: Inflation is still high and causing economic pain.

- Americans are still feeling the sting of this inflation crisis—prices are up 15.5 percent under Biden.

- Inflation remains over three times higher than just a couple years ago.

- The average family of four is paying $13,717 per year or $1,143 per month more to purchase the same goods and services as in January 2021.

BIDEN CLAIM: “President Biden and Congressional Democrats are delivering historic Investments in America that are creating good jobs around the country and revitalizing our communities.” The President “put policies in place that have contributed to more than $470 billion in private sector investment commitments.”

FACT CHECK: The “historic investments” made by Democrats don’t help the middle class.

- The “Inflation Reduction Act” enacted by Democrats last year gave $271 billion in tax credits to pay for “green” energy projects that even liberals admit are a boon for the top 1 percent.

- These out of control “green” handouts are going to cost American communities an estimated $1.2 trillion, according to independent analysis by Goldman Sachs, nearly $1 trillion higher than original estimates.

- Companies with over $1 billion in sales receive more than 90 percent of special interest green energy tax subsidies.

- Some analysts estimate that banks and insurers alone receive over half of green energy checks, far more than any other industry or sector.

BIDEN CLAIM: Democrats are “supporting investments that have resulted in 800,000 manufacturing jobs, nearly doubling manufacturing construction, and more resilient US supply chains.”

- 49.7 percent of the tax will be borne by the manufacturing industry, according to analysis by the non-partisan Joint Committee on Taxation.

- The Tax Foundation estimates this new tax will cost 20,000 jobs and slow investment and economic growth.

- Workers in Indiana, Wisconsin, Michigan, North Carolina, and Kentucky would endure the largest economic hit from the new tax, according to the Heritage Foundation.

BIDEN CLAIM: Biden set “out to rebuild American infrastructure, so that we no longer rank 13th in the world but instead have world-class infrastructure.” The President enacted “the largest investment in combatting the climate crisis in U.S. history,” paving the way for hundreds of thousands” of good-paying jobs.

- China—Batteries

- Today, China controls over 50 percent of the processing capacity of key EV battery inputs like lithium, cobalt, and graphite.

- China’s influence over the EV supply chain widens to around 90 percent in manufacturing and processing in a number of battery materials and minerals.

- According to a report from the liberal think tank SAFE, 60 to 100 percent of all battery minerals are processed in China.

- China—Solar

- According to the U.S. Department of Energy, China controls nearly 80 percent of the entire solar production supply chain, including 97 percent of solar wafers capacity, 81 percent of solar cell capacity, and 77 percent of global capacity for finished solar modules or panels.

- China—Wind

- After the IRA passed, global wind turbine orders reached record levels, 90 percent higher year-over-year in Q4 2022, with 65 percent of those orders attributable to China.

- Despite buses and rails accounting for only a tiny fraction of Americans’ travel, mass transit and Amtrak receive the same amount of funding as highways.

- The bill includes over $15 billion in woke climate funding initiatives that will simply healp wealthy Americans buy more electric vehicles.

BIDEN CLAIM: “President Biden has signed legislation to reduce the deficit by more than $1 trillion” and is “committed to ensuring the wealthiest Americans and largest corporations pay their fair share and lowering prescription drug costs by cutting wasteful giveaways to Big Pharma.”

- In 2021, keeping spending at the levels projected in January 2020 or February 2021 would have resulted in the 2021 deficit being $2.0 or $1.1 trillion lower, respectively.

- In 2022, the deficit would have been between $400 billion and $1.2 trillion lower given had spending remained at the levels projected in any of the three prior CBO baselines.

.png)

.png)

- Notably, had spending in 2022 been what CBO projected it would be when Biden took office – without the impact of his failed economic policies – the budget deficit would have been its lowest since 2001, which was the last time the government ran a surplus.

- Had spending stayed at any of the previously projected levels for both years, combined deficits would have been between $1.5 and $3.2 trillion lower than the actual deficits incurred.

Government spending is the primary driver of deficits and President Biden and Congressional Democrats have engaged in an unprecedented $11 trillion partisan spending spree, including:

- $709 billion on student loan waivers and giveaways that forces the 87 percent of Americans without student loans to pay for the loans of the 13 percent who do.

- An $80 billion slush fund for the IRS to hire 87,000 new agents.

- Roughly $100 billion bailout of union multiemployer pension plans that overpromised and underdelivered for their workers, ultimately offloading the costs onto the American taxpayers.

.png)

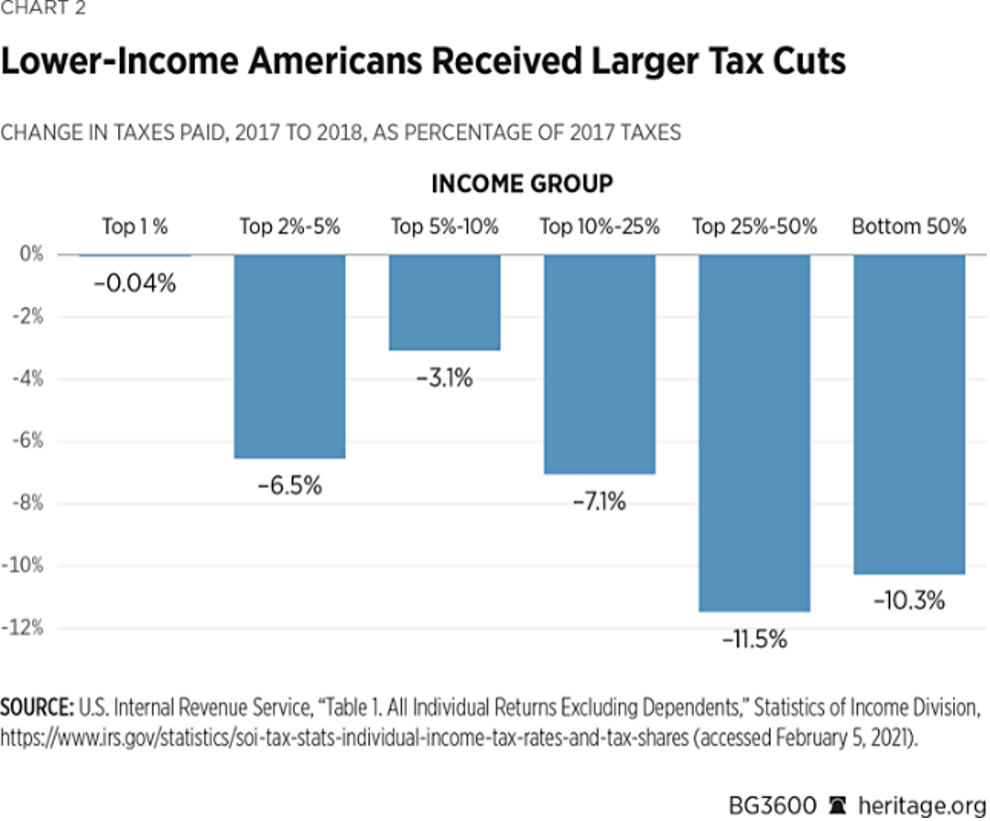

BIDEN CLAIM: “In contrast, House Republicans want to: Enact massive tax cuts for the wealthiest Americans and largest corporations – adding trillions of dollars to the deficit in order to deliver a $175,000 average annual tax cut to the top 0.1 percent (incomes over $4 million).”

The Heritage Foundation explains:

- “Tax cuts as a percentage of taxes paid in 2017 were largest for the lowest-income Americans and smallest for the top 1 percent, measured by adjusted gross income (AGI).

- “Similarly, the percentage decrease in effective tax rates was about 5 percent for the highest-income group, and 16 percent for the half of Americans whose income is below the median.

- “After the Tax Cuts and Jobs Act of 2017 (TCJA), higher-income taxpayers now pay a larger share of all taxes. By this metric, the income tax system was made more progressive. The top 1 percent of taxpayers paid 40 percent of income taxes in 2018, and 38 percent in 2017.”

Meanwhile, Biden’s supercharged IRS stands to target families making under $400,000 a year:

- The Congressional Budget Office (CBO) confirms that Democrats’ Inflation Act, which supercharges the IRS with 87,000 new agents, will lead to more audits and enforcement measures, and higher taxes for families making less than $400,000.

BIDEN CLAIM: “Our recovery is the strongest of any major economy.”

FACT CHECK: President Biden’s policies have driven us back into a recession.

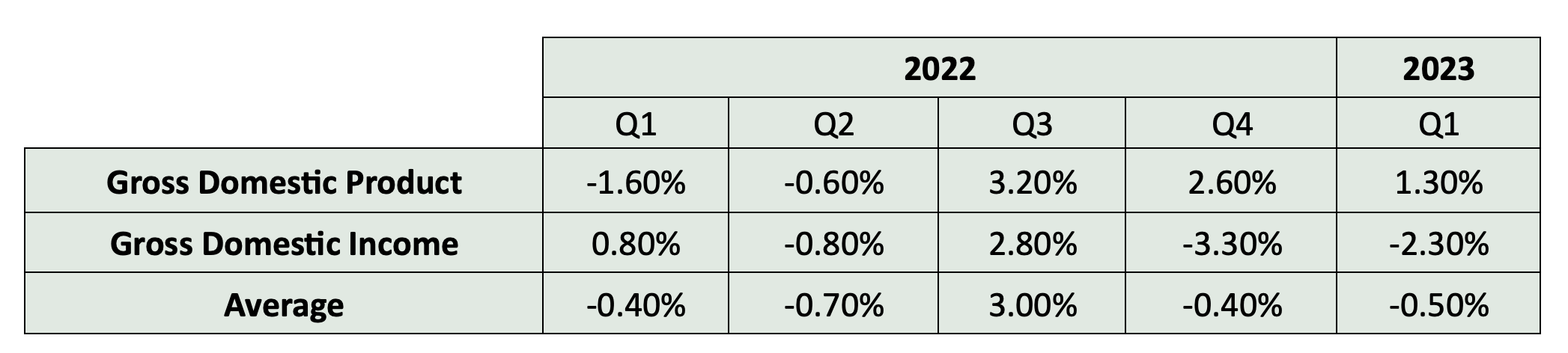

After experiencing consecutive quarters of declining Gross Domestic Product (GDP) to start 2022, the Biden administration was quick to divert attention to alternative measures of economic output, such as Gross Domestic Income (GDI).

However, as House Budget Committee Republicans observed last month, these alternative measures no longer point in the administration’s favor. GDI – which measures the economy through things like income, profits, and taxes rather than production — has decreased in each of the past two months.

- Gross Domestic Output (GDO), which is the average of GDP and GDI, and was once described by the Obama Council of Economic Advisers as being “a better gauge…of GDP growth than either GDP or GDI individually” has also experienced negative growth in 4 of the last 5 quarters.

- According to a recent report by Heritage, “the latest economic data show the economy might be doing a ‘double dip,’ where a recession is followed by a brief period of growth and then another recession.”

- President Biden’s policies are projected to cause the slowest economic growth in almost a century.

.png)

BIDEN CLAIM: “Family economic security is stronger than pre-pandemic.”

- Household net worth is 4.7 percent lower than when President Biden took office when adjusting for inflation.

- Credit card debt, adjusted for inflation is 14.6 percent higher than when President Biden took office.

- The monthly mortgage payment on an average home has doubled during Biden’s presidency, increasing from $1,300 to $2,600.

BIDEN CLAIM: “Gas prices are down from their summer 2022 peak.”

FACT CHECK: Gas and energy prices remain significantly higher than when President Biden took office.

- Gas prices are over 34 percent higher than when President Biden took office.

- Energy prices are up 28.5 percent from when President Biden took office.