ICYMI: Interest on the Debt is a Ticking Time Bomb

Interest rates are growing rapidly, and American families are paying the price.

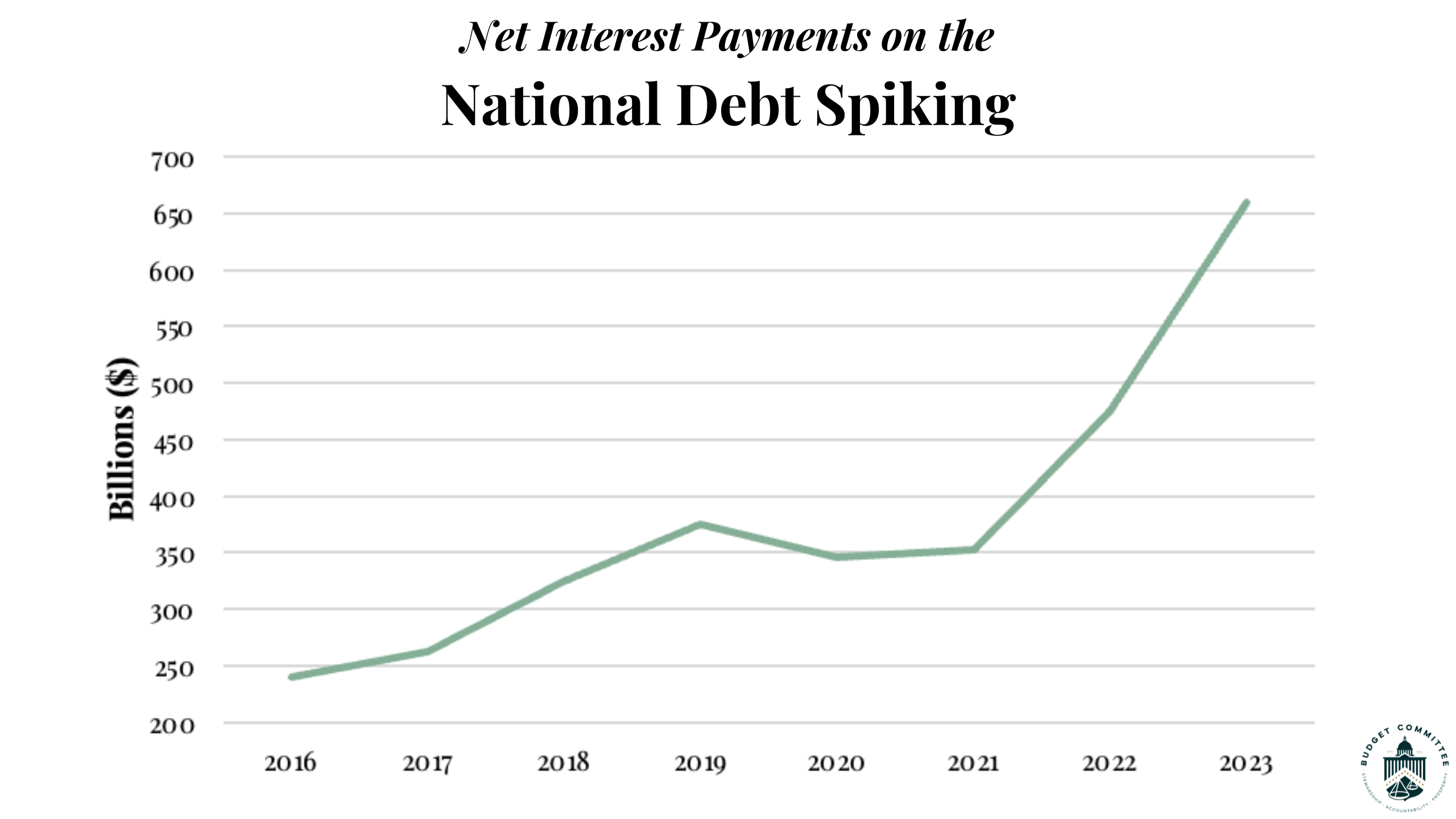

Interest payments on the debt are adding up and absorbing recourses that could be spent on programs Americans rely on, including border security, national security, and healthcare. Raised rates are also adding to the already out-of-control debt that’s driving up inflation for the goods and services Americans rely on.

A recent Washington Post article lays out how the debt is a ticking time bomb and sounds the alarm on the snowballing cost of raging interest rates.

Word on the Street:

Via The Washington Post:

- “The United States spent more on interest than on all federal programs for children, including childcare, education and tax credits for families, according to the Committee for a Responsible Federal Budget, which advocates for a lower deficit.”

- “Within three years, if interest rates remain elevated, payments on the debt could become the second-largest federal program — behind only Social Security, which provides pensions for tens of millions of seniors, analysts say.”

- “In 2021, the nonpartisan Congressional Budget Office projected payments on the debt would cost roughly $5.4 trillion the next decade. In May of this year, it projected payments on the debt would rise to $10.6 trillion over the next decade, or to 2033”

- ““The federal government is sitting on a ticking time bomb. Payments on the debt already doubled over the last two years, and are expected to double again over the next decade,” Riedl said. “Congress remains completely asleep at the wheel, and unwilling to make even minor gestures toward reining in the toxic combination of rising debt and higher interest rates.’”

- “’Rising net interest payments are bad because we have so many other priorities we need to focus on — child care, health care, the continued housing crisis,” said Kyla Scanlon, a financial analyst who founded Bread, which produces financial education. “And now, Wall Street seems unwilling to absorb new issuance as debt grows faster than the economy. If Wall Street freaks out and stops accepting debt levels and demanding higher compensation for accepting said debt, that would put a lot of pressure on the U.S. government, and exacerbate the issues that we are already seeing with foreign demand, corporate financing, mortgage rates, and more.”

Big Picture:

The federal debt has skyrocketed almost 800 percent since 2000, as of today the debt is costing a shocking $256,316 per household.

This alarming reality must be reversed as quickly as possible. According to the nonpartisan Congressional Budget Office (CBO), interest payments on the debt will triple under current law from $457 billion (1.9 percent of GDP) in 2022 to $1.4 trillion (3.7 percent of GDP) in 2033. This will be the highest level in American history.

In less than five years, interest payments on the debt will exceed what we spend on national defense. By 2033, interest payments will be the third most expensive federal program.

Those dollars spent on interest costs do not go towards the American people. They should be used towards fixing our crumbling infrastructure, supporting our foreign allies, supporting healthcare and childcare. We must stop throwing this money away and start reinvesting these funds back into the American people.

The Bottom Line:

Interest rates are growing rapidly, and the consequences will be dire.

Our nation is facing a costly problem that is only going to get worse unless we balance our deficit. If we fail to do that, we will continue to spend billions of dollars on interest to the debt. The future of interest payments is a key factor to our federal budget deficit and our fiscal

Our priority should be on the American people, and The House Budget Committee is dedicated to Reverse the Curse of this fiscal burden on the American people.