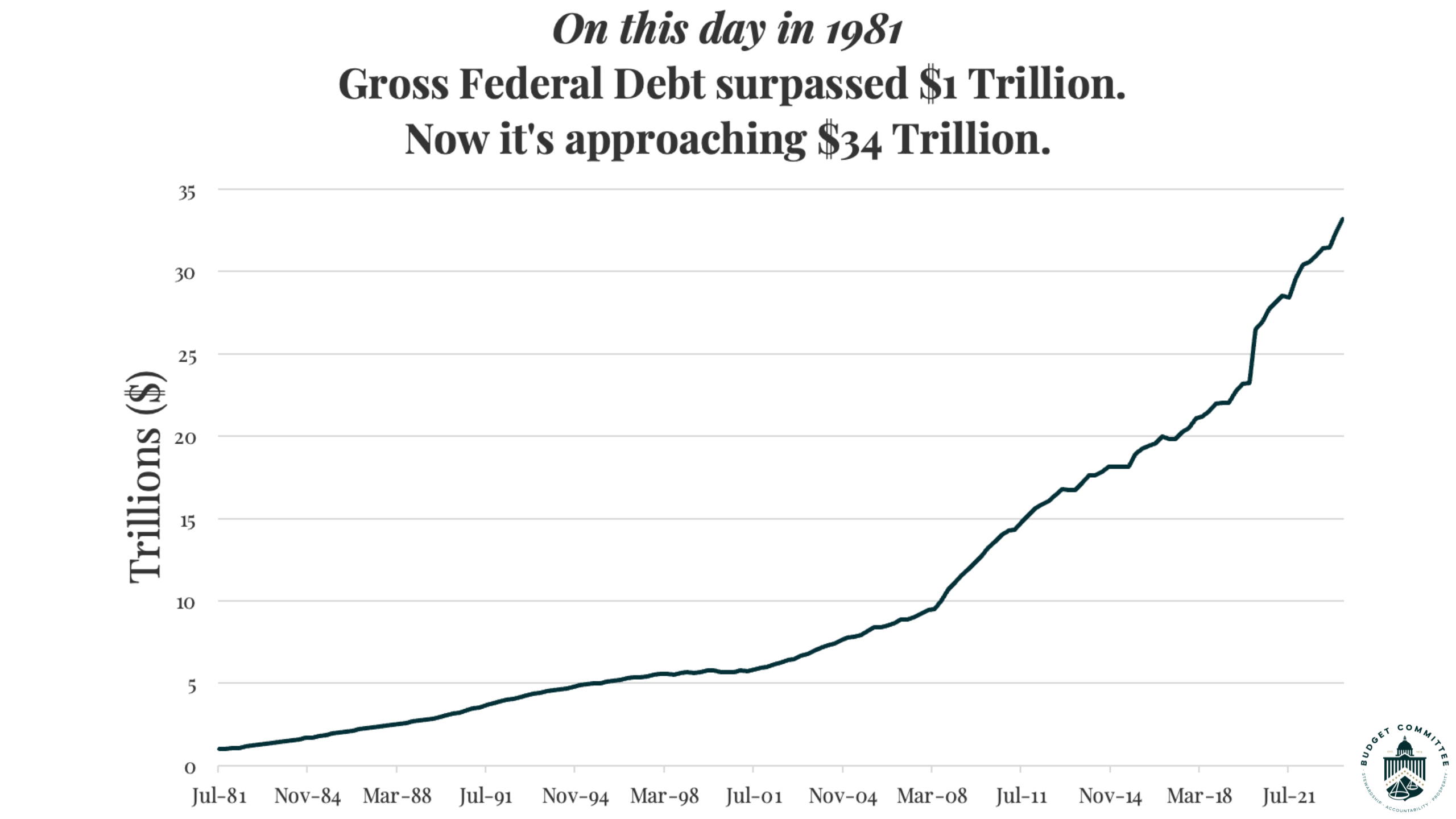

NOT-SO-HAPPY ANNIVERSARY: Forty-two years ago today, the national debt crosses the $1 trillion mark

On October 23, 1981, America’s national debt crossed the $1 trillion mark. It was an unprecedented, staggering, and earth-shattering figure. President Reagan was merely nine months into his presidency, presiding over an economy in turmoil after years of the reckless “reluctant Keynesian” economic policies of the preceding Carter Administration. Unhinged government spending and out-of-control money printing caused inflation to skyrocket and the U.S. dollar to crash, putting the prosperity of the American people at risk and jeopardizing America’s leadership in the world.

President Reagan said, sounding the alarm on the impact of America’s debt, "If we as a nation needed a warning, let that be it."

Where We Are Today:

Our national debt EXCEEDS $33 trillion, jeopardizing prosperity for hardworking families, threatening job creators, and eroding our leadership in the world.

The gross national debt today equates to $256,316 per household, or $100,901 per person. President Biden has increased the national debt by $5.88 trillion since taking office, effectively adding $44,796 more debt and $5,335 in interest payments per average U.S. household. The deficit for 2023 is projected to be $2 trillion. This is equal to $15,244 more money spent than earned per household.

The debt has increased by a staggering $2.39 trillion in just the past year. We are spending around $6.55 billion per day due to our Presidents bad financial decisions. We are on an unsustainable and harmful path.

Word on the Street via The Washington Post:

“In the past few weeks, as the debt total approached the new benchmark, political figures from President Reagan on down have invoked the trillion-dollar liability as a symbol of government spending run amok.”

“By 1835, the government had reduced its debt to the lowest level ever--$37,513. Then budget deficits, due largely to military spending, sent the debt back up, and the total reached $1 billion midway through the Civil War. It took another 110 years, until 1974, for the figure to reach $500 billion. In other words, half of the current trillion-dollar debt was incurred in the last seven years.”

“In fiscal 1982, for the first time, the government will pay more than $100 billion in interest on its debt. Interest payments now constitute the third largest item in the federal budget, behind benefit payments (such as Social Security) and national defense.”

“If the debt keeps increasing at about the current rate, it will hit $2 trillion before the end of the 1980s.”

The Bottom Line:

Four decades ago, the thought of having a $1 trillion national debt was mind-boggling enough to force a national conversation on the fiscal health of our nation. As our debt continues to explode, now exceeding $33 trillion, we have no choice but to renew these concerning conversations and fundamentally change how Washington spends. For far too long, American have felt the pain of uncapped government spending and they deserve to have their representatives fight for a more prosperous future.

The House Budget Committee turned words into action to restore America’s fiscal sanity by passing the Reverse the Curse budget resolution, which cuts the deficit by $16 trillion and balances the budget in ten years.