ICYMI: Why President Biden’s Moratorium on Student Loan Repayments was a Bad Idea

The endless extension of what was supposed to be pandemic-related relief through the student loan payment moratorium turns out to have hurt everyday Americans—including the student loan borrowers themselves.

House Republicans have been leading the charge to stop President Biden’s student loan bailout for the wealthy and end the permanent pandemic narrative used by the Administration to justify these costly executive actions.

- For every month borrowers were allowed to skip payments, $4.3 billion was added to the American taxpayers’ tab.

- Forty-one months later, the moratorium has cost American taxpayers approximately $176 billion.

- A recent analysis found that Biden’s plan to cancel loans and transfer the burden from wealthy borrowers to working-class Americans will cost the average taxpayer over $3,500, according to the National Taxpayers Union Foundation.

If this wasn’t bad enough, a new piece out this week from The Economist sheds further light on just how disastrous the endless continuation of pausing student loan payments has been for the U.S. economy.

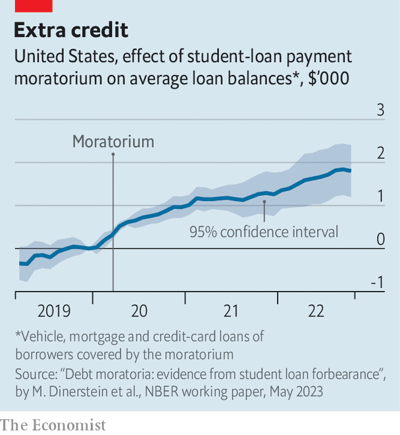

The Takeaway: University of Chicago economists found that the student-loan payments pause caused Americans to rack up more consumer debt.

- “By the end of 2022 beneficiaries of the moratorium accumulated an additional $2,500 in student-loan debt.”

- Borrowers also racked up “an additional $2,000 in credit-card, mortgage and car-loan debt, boosting total household indebtedness by 8%.”

As the authors of this article said: “Biden warned that the resumption of student-loan payments could lead to ‘significant economic hardships’ for millions of borrowers. Little did he know that his own policies would be partly to blame.”

CLICK HERE to read the full article. CLICK HERE to learn more on how much the student loan moratorium has costs taxpayers.