H.R. 3746, THE FISCAL RESPONSIBILITY ACT OF 2023: Frequently Asked Questions

I. DEFICIT REDUCTION

QUESTION: Is this the largest deficit reducing bill in history?

ANSWER: Yes. The previous record is the Budget Control Act of 2011 which, including lower interest costs, was scored by CBO as reducing the deficit by $2.117 trillion over ten years.

This legislation reduces deficits by a total of $2.13 trillion, resulting from:

- $1.3 trillion savings over ten years from the fiscal years 2024 and 2025 discretionary spending caps.

- $553 billion savings over ten years from congressionally enforced discretionary spending caps in 2026-29.

- $8 billion other savings.

- $240 billion net interest savings.

QUESTION: Does the FRA reflect the key principles of the Limit, Save, Grow Act?

ANSWER: From the beginning of this process, Republicans insisted that President Biden add fiscal restraint to accompany any effort to raise the debt limit. Polls show the American people feel the same: CNN found that 60 percent of Americans want to see the debt limit raised alongside spending cuts.

The FRA, if enacted, would be the largest cut to the federal deficit in American history. It raises the debt limit to avoid a catastrophic default and protects our veterans, seniors, and national security priorities.

Republicans believe any effort to responsibly raise the debt limit must also include policies to reduce out-of-control spending and grow our economy. The Fiscal Responsibility Act does both.

QUESTION: Is there anything in this bill to stop President Biden’s army of auditing agents?

ANSWER: The FRA is the first step to protecting American taxpayers from Biden’s supercharged army of IRS auditing agents.

- The FRA rescinds $1.4 billion in funding provided for IRS in the Inflation Reduction Act; the full amount of funds included in their FY23 spend plan for non-taxpayer services.

- This will slow down the IRS’s planned hiring spree and weaken the Biden Administration’s plan to target working-class Americans and small businesses with audits for FY 24.

QUESTION: Are caps an effective mechanism for Republicans to curb federal overspending?

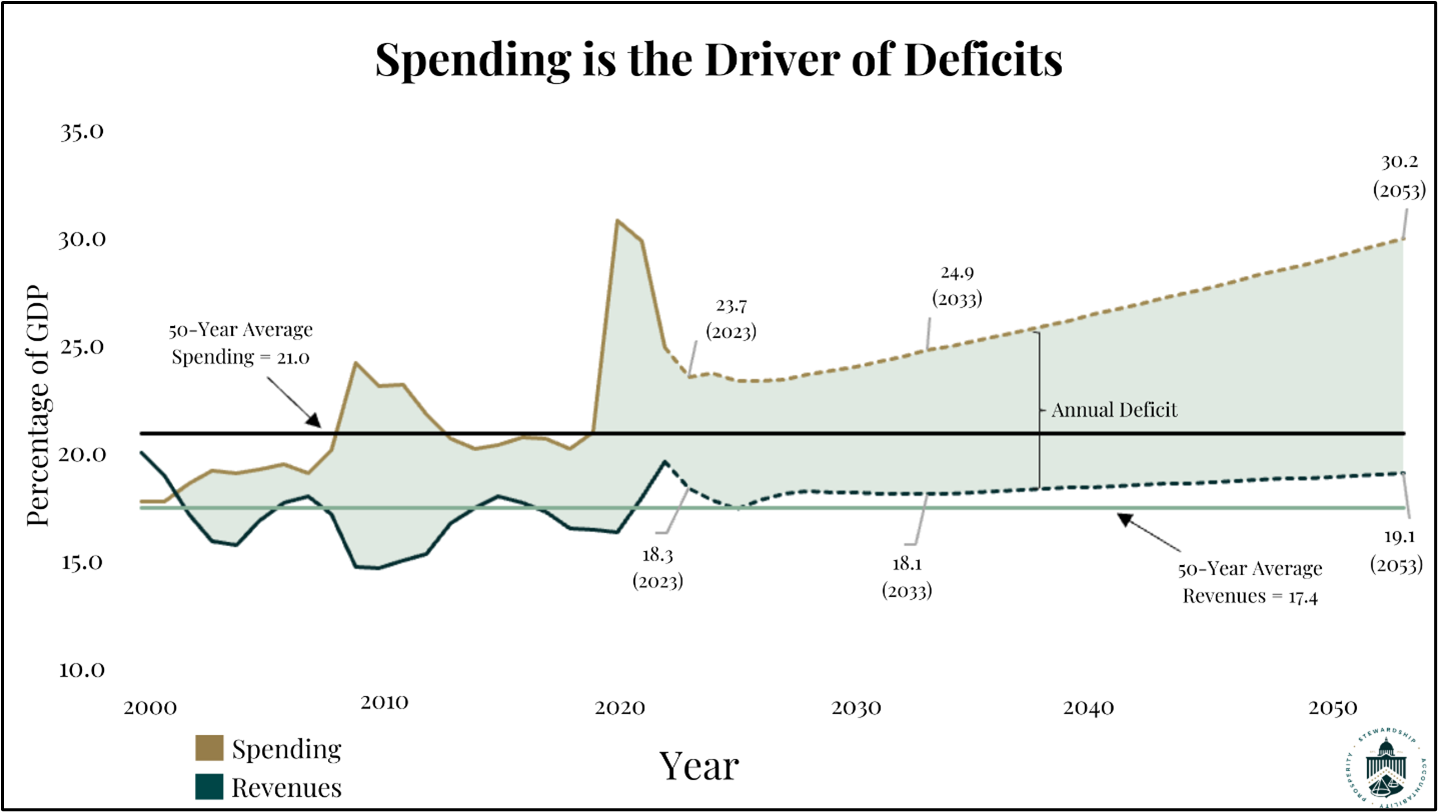

ANSWER: Yes, the Congressional Research Service (CRS) cites that budget caps are an effective method to reduce wasteful discretionary spending. In periods with budget caps in place, discretionary budget authority grew at a slower pace year to year compared to times without caps.

Even further, the Congressional Budget Office (CBO) states that in the absence of future caps discretionary budget authority will continue to grow to keep pace with inflation.

Luckily, cost estimates for statutory caps for both FY2024 and FY2025 included in FRA demonstrate that discretionary budget authority will be reduced by $246 billion in these two years. And by reducing the starting point for future increases, the two-year caps alone cut discretionary spending over ten years by $1.5 trillion in budget authority ($1.3 trillion in outlays).

QUESTION: President Biden released his budget in March which, if enacted, would have rolled out $4.7 trillion in new taxes, and saddled the nation with $51 trillion in total debt over the next 10 years. Will House Republicans release their own budget? If yes, then when?

ANSWER: For the past three months, Speaker McCarthy and House Budget Republicans have been laser-focused on preventing an unprecedented default on the national debt. Instead of meeting Republicans at the negotiating table, the Biden Administration and Congressional Democrats wasted a precious 100 days by fearmongering and producing no legislation.

Following passage of Limit, Save, Grow Act (LSG), and subsequent passage of FRA, House Republicans have delivered on their commitment to protect the U.S. and our allies from a default- based global economic crisis.

Passage of the FRA paves the way for crafting and releasing a Republican budget. The historic deficit reductions included in the FRA will create a new and improved budgetary outlook for the future fiscal state of the federal government.

While President Biden’s budget proposes deficits of $17 trillion over the next decade, House Budget Republicans will continue to work towards releasing a budget resolution proposal that eliminates wasteful spending, reduces our national debt, and has the support the House Republican Conference.

QUESTION: Will rescinding unspent COVID funds take money away from local governments?

ANSWER: No. All state and local recovery dollars have been sent out by the Treasury Department; the FRA will not impact these funds.

There are approximately 20 accounts each with more than $150 million of unobligated funds for COVID that will be rescinded in the FRA, totaling $27.1 billion.

QUESTION: Enacting work requirements for Food Stamps stands to cost the taxpayers over $2 billion dollars. What are the long-term benefits of work requirements?

ANSWER: Helping Americans get back to the workplace has short- and long-term benefits beyond what a CBO score can capture.

When people are employed as opposed to being on welfare, crime is reduced, small businesses flourish, wages increase, unemployment costs go down, and more people enjoy employer-sponsored—as opposed to Washington-controlled—health care.

QUESTION: Democrats say that the wealthy are not paying their fair share in taxes and demanded new taxes be included in the debt limit. Does the FRA contain any tax increases?

ANSWER: Despite Democrats’ demands, House Republicans succeeded in blocking tax hikes from being included in the FRA include.

The $31.4 trillion national debt is a result of Congress’ spending problem, not a lack of revenue. Republican passage of the Tax Cuts and Jobs Act increased revenues from $3.3 trillion in 2017 (the year before TCJA took effect) to $4.9 trillion in 2022. That is an increase of $1.6 trillion or rather, 48 percent.

President Biden and Congressional Democrat’s partisan spending eroded the success of Republican tax reform by extracting billions from the American working class to offset costs of their two-year spending spree.

Data from the nonpartisan CBO and Joint Committee on Taxation (JCT) confirms that President Biden’s actions will result in an extra $732 billion in taxes on workers and businesses over the FY 2021 to 2033 period. Examples of their harmful tax increases include:

- $222 billion tax increase on businesses by imposing a corporate minimum tax in the Inflation Reduction Act (IRA).

- $180 billion in projected higher revenue from expanding the IRS in the IRA.

- $73.7 billion tax increase from the stock buyback tax in the IRA.

- $83.8 billion in limit on tax deductions that small businesses can claim for losses in the American Rescue Plan Act and the IRA.

II. DISCRETIONARY SAVINGS

QUESTION: What is a hard cap? How is this different from a soft cap? And how are they employed in the FRA?

ANSWER: “Hard caps” are limits enforced by law (also known as “sequestration”) whereas “soft caps” are spending limit “suggestions” (as written in statute not enforced by a sequestration).

In the FRA, hard caps establish statutory discretionary spending limits for FY 2024, as well as for FY 2025, defense and non-defense spending.

- Both the defense and non-defense discretionary spending limits would be enforced by a sequester (i.e., across-the-board spending cuts) if enacted appropriations for either fiscal year exceed their respective spending limit.

- FY 2021 was the last year that discretionary spending limits were enforced by sequestration.

For FY 2026 through FY 2029, the FRA sets an overall limit on discretionary spending for the purposes of Congressional budget enforcement.

- As opposed to FY 2024 and FY 2025, these caps would be “soft” because they would be dependent on a future Congress to budget and appropriate within these limits.

- These limits would not be enforced through a sequestration order (i.e., across-the-board spending cuts) under law.

QUESTION: What is a simple explanation of how the FRA affects the appropriations process?

ANSWER: The FRA advances the Republican mission to get our nation’s fiscal house in order by curbing Democrats’ reckless spending, reining in the runaway bureaucracy, and reviving our economy through pro-growth policies.

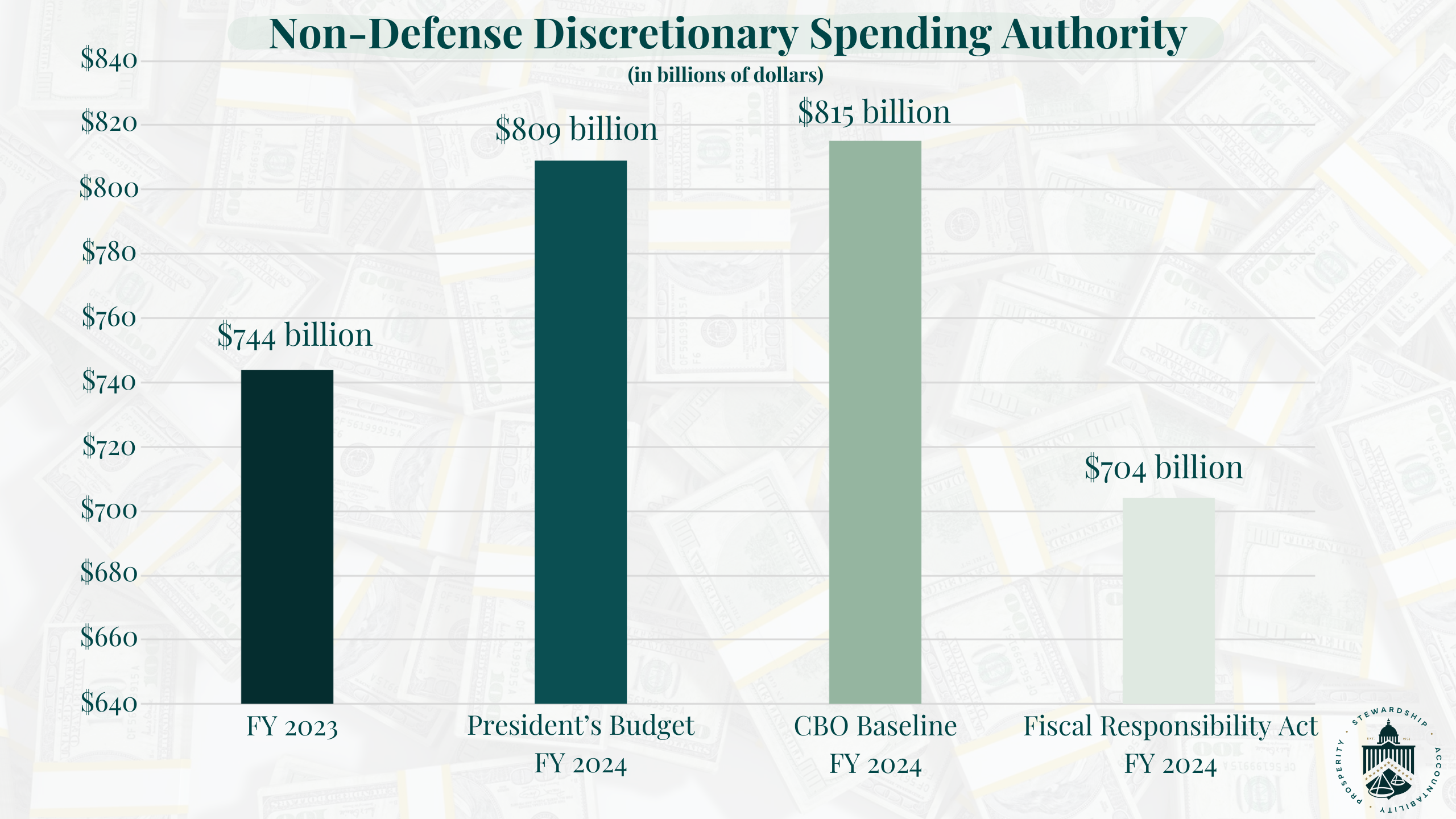

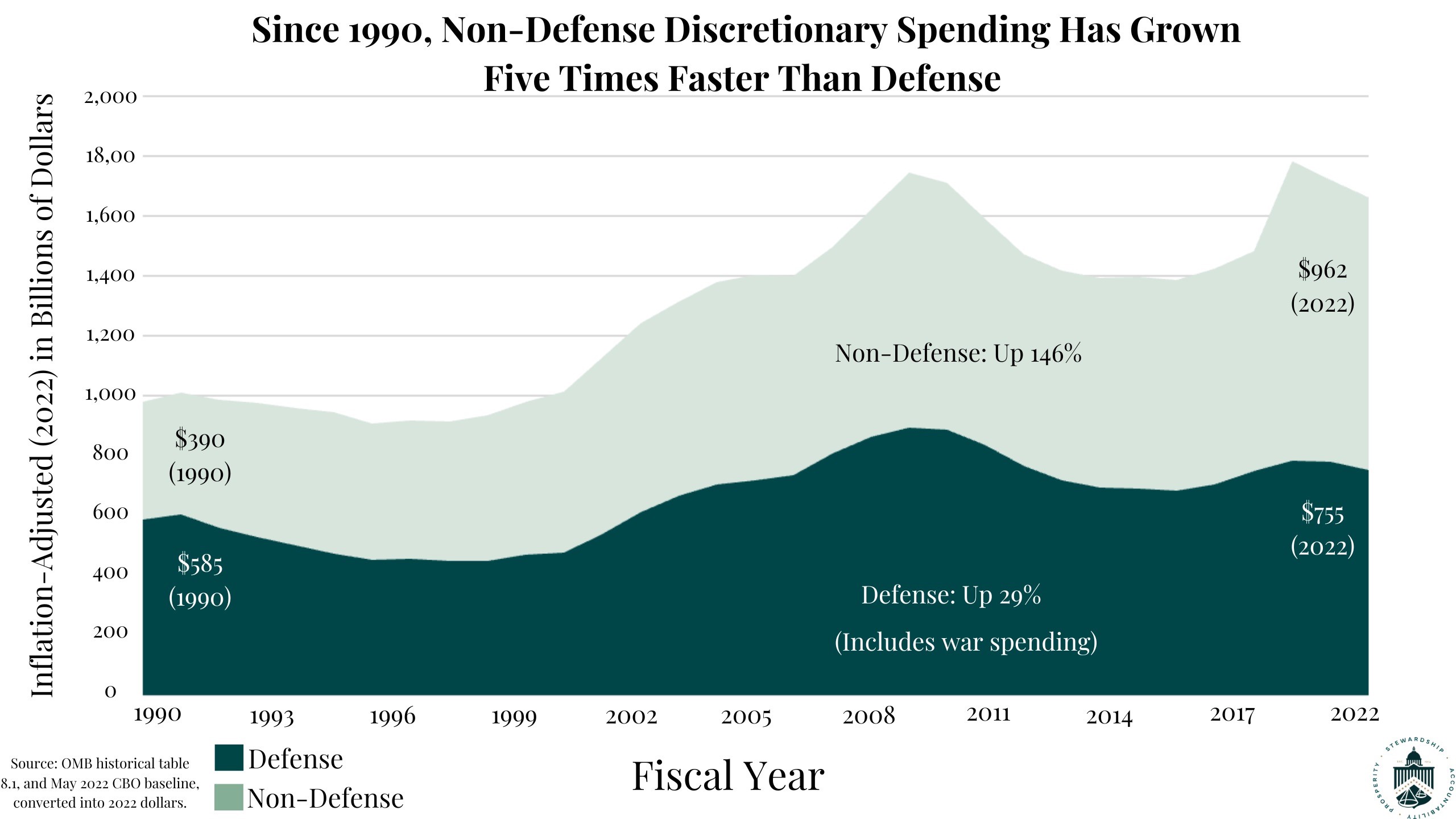

- Largest Non-Defense Reduction Ever: The legislation reduces non-defense discretionary spending by $40 billion (or 5.4 percent)—the largest ever reduction. Such spending would be limited to $704 billion from last year’s level of $744 billion, a reduction of $111 billion compared to the CBO baseline and $105 billion below the President’s request. Non-defense discretionary spending has previously increased in 32 of the last 37 years.

- Non-Veterans, Non-Defense Spending Below FY 2022 Levels: Non-defense spending, outside of veterans’ medical care (assuming enactment of the President’s request of $121 billion), would be limited to $583 billion in FY 2024. This is a reduction of $42 billion compared to last year ($625 billion) and $9 billion compared to FY 2022 ($592 billion).

- Defense Spending Increase: The defense spending limit is $886 billion in FY 2024, a $28 billion or 3.3 percent increase compared to FY 2023 ($858 billion).

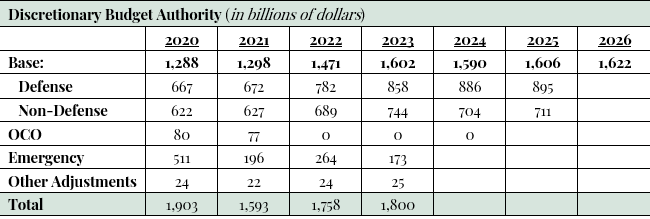

- First Discretionary Spending Cut in 11 Years: The legislation provides a total discretionary spending limit of $1.59 trillion ($886 billion defense, $704 billion non-defense) in FY 2024, a reduction of $12 billion compared to FY 2023. This provides the first cut to base discretionary spending authority in more than a decade. The total spending limit for FY 2024 is $110 billion below the CBO baseline and $105 billion below the President’s FY 2024 Budget.

QUESTION: What happens if all 12 appropriations bills are not passed on time?

ANSWER: The FRA incentivizes Congress to complete the appropriations process. To ensure this happens:

- The FRA would establish temporary caps at 99% of current funding levels (FY 23) if all 12 appropriations bills are not passed by January 1 of either 2024 or 2025, respectively.

- Such provisions are designed to reaffirm bipartisan, bicameral timeliness and accountability throughout the appropriations process.

QUESTION: Doesn’t the bill lock in inflated spending levels due to COVID funding?

ANSWER: No. Last year’s omnibus set base discretionary spending authority at $1.602 trillion.

The FRA sets the comparable total discretionary limit at $1.59 trillion for FY 2024, a $12 billion reduction. While last year’s base discretionary funding level of $1.602 trillion level was inflated by President Biden and Congressional Democrat’s partisan lawmaking, it was not impacted by COVID funding which was emergency-designated and outside of this allocation.

III. NEW CONTROLS ON BIDEN’S SPENDING

QUESTION: How does the FRA claw back the Biden Administration’s $11 trillion spending spree?

ANSWER: The FRA returns the power of the purse back to where the Constitution put it: the people’s representatives in Congress.

Here’s how:

- Stops the student loan bailout for the wealthy.

- The FRA finally halts the federal student loan moratorium and interest pause (effective August 31, 2023).

- For every month borrowers were allowed to skip payments, $4.3 billion was added to the American taxpayers' tab.

- Forty-one months later, the moratorium has cost American taxpayers approximately $176 billion.

- Rescinds excessive COVID emergency and IRS funds.

- The bill reclaims funding from Biden’s excessive COVID stimulus packages and claws back his IRS’s ability to audit small business and middle-class taxpayers.

- The bill rescinds nearly $28 billion in unobligated funding from COVID spending bills.

- $1.39 billion is slashed from the IRS’s slush fund, equal to the amount the IRS planned to use in FY 2023 on new tax enforcement agents.

- ??Requires the Executive Branch to offset any potential future spending increases.

- Before the Executive Branch can finalize any covered discretionary action that increases direct spending by more than $1 billion over 10 years or $100 million in a single year, the agency head must submit a written notice–including the estimated budgetary effects of the action.

- The FRA requires the Executive Branch to propose one or more administrative actions that reduce direct spending by more than or equal to the cost of the covered discretionary administrative action for the Office of Management and Budget (OMB) Director’s review.

- If the OMB Director determines that no proposed offset is included, then the written notice is returned to the agency and the agency must resubmit the notice.

- Just like the Trump Executive Order on administrative PAYGO, the provision includes waiver authority for the OMB Director for exigent circumstances. Any such waiver must be made public and scrutinized by GAO for possible congressional action to block the new administrative spending

IV. PRO-GROWTH POLICIES

QUESTION: How does the FRA prioritize permitting reform?

ANSWER: The FRA contains provisions from the “Building United States Infrastructure through Limited Delays and Efficient Reviews (BUILDER) Act of 2023” that amount to the most significant reform to the National Environmental Policy Act (NEPA) since 1982.

These provisions include:

- Shortening environmental review timelines.

- Putting a lead agency in charge of a project's environmental review.

- Setting a one-year deadline for producing environmental impact assessments and a two-year maximum for environmental impact statements.

- Expanding an existing program to expedite federal permitting for infrastructure projects.

- Adding energy storage to the list of covered projects eligible for streamlining under the FAST Act.

The FRA would also approve the immediate completion of the Mountain Valley Pipeline, a project that stands to provide over $5.9 billion in economic activity and approximately 5,800 jobs.

QUESTION: What are the new work requirement provisions? What are their benefits?

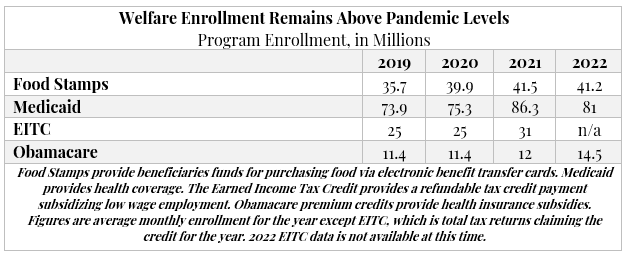

ANSWER: More people are receiving welfare benefits today than at any time in our nation’s history.

- In 2022, 81 million people were enrolled in Medicaid (26.7 percent of the population) and 41 million received Food Stamps (12.4 percent of the population).

- This is even higher than at the height of the pandemic and government lockdowns.

- Experts estimate that today nearly four million able bodied adults without dependents are enrolled in the Food Stamps program, with three-quarters of these individuals not working at all.

- Similarly, according to the Department of Health and Human Services (HHS), 603,585 of the nearly 700,000 adults receiving Temporary Assistance for Needy Families (TANF) benefits in 2021 were work eligible. Yet, 61 percent of these work-eligible individuals did zero hours of work in FY 2021.

The FRA adds and strengthens work requirements for able-bodied adults without dependents who receive money from federal welfare programs—measures that will return the nation to the workplace and, most importantly, help lift Americans out of poverty.

- The bill resets the baseline for calculating caseload reduction credits and cracks down on state-led gimmicks that used TANF funds to fill budget holes instead of reconnecting Americans with work.

- This legislation would also create a new pilot program for states to negotiate performance benchmarks for work and family outcomes.

It also increases the maximum age of eligibility on work requirements for those receiving food stamps.