U.S. Debt Credit Rating Downgraded, Only Second Time In Nation’s History

“This is a wakeup call to get our fiscal house in order before it’s too late."

Topline: On August 1, 2023, Fitch Ratings, one of only three private credit rating firms, downgraded its U.S. credit rating from AAA to AA+. They say what Republicans have been repeatedly warning our colleagues: Spending and debt is unsustainable; interest costs are out of control; inflation and interest rate hikes have weakened our economy; we will be in recession by the end of the year; the fiscal outlook only gets worse; our debt-to-GDP has hurt U.S.’s ability to absorb a major financial shock in the future; and if we don’t change course, the U.S. will not only incur another credit downgrade, we will undermine the dollar as the global reserve currency.

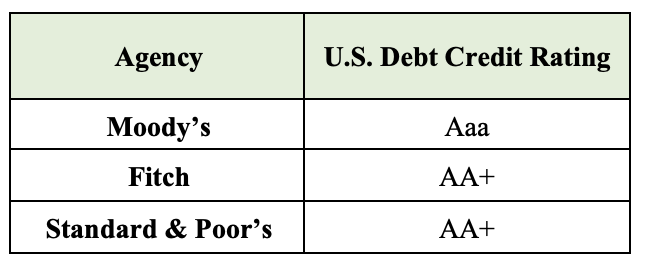

Credit rating agencies, such as Fitch, Moody’s, and Standard & Poor’s, provide ratings of the creditworthiness of debt issuances (from sovereign nations, municipalities, and corporations) as a tool for investors. These ratings generally range from a high of AAA to D, with ratings below BBB- often considered “noninvestment grade” or “junk”.

The U.S. government currently has a top Aaa rating from Moody’s, and second-tier AA+ ratings from both Fitch and S&P.

The U.S. Government’s Credit Rating and The Fiscal State of the Nation

Credit ratings are based on a country's current and forecasted fiscal status, including things such as debt-to-GDP and overall economic health, to evalute a country's ability to pay their debt.

Debt held by the public grew from 39 percent of GDP in 2008 to over 100 percent today. Over the next 30 years, debt is projected to increase to 181 percent of GDP under current law, driven by increase mandatory/ entitlement spending, interest expenses, and health care costs.

$11 trillion in spending has resulted in record inflation and interest rate hikes, which is causing a downward economic spiral. Fitch says we are headed for a recession—and it is totally self-inflicted.

As House Budget Chairman Jodey Arrington stated:

“With annual deficits projected to double and interest costs expected to triple in just ten years, our nation’s financial health is rapidly deteriorating, and our debt trajectory is completely unsustainable. This is a wakeup call to get our fiscal house in order before it’s too late."

2023 Fitch Downgrade

Why this happened: Fitch described the key drivers of the rating downgrade: “The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to 'AA' and 'AAA' rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

- Debt-to-GDP expected to rise: Fitch’s report highlights that the U.S. government “debt-to-GDP ratio is projected to rise over the forecast period, reaching 118.4 percent by 2025. The debt ratio is over two-and-a-half times higher than the 'AAA' median of 39.3 percent of GDP and 'AA' median of 44.7 percent of GDP. Fitch's longer-term projections forecast additional debt/GDP rises, increasing the vulnerability of the U.S. fiscal position to future economic shocks.”

- Problems on the horizon: Fitch stated there is a “marked increase in general government debt, for example due to a failure to address medium-term public spending and revenue challenges.” Those challenges facing the federal budget are significant. According to the report, “Over the next decade, higher interest rates and the rising debt stock will increase the interest service burden, while an aging population and rising healthcare costs will raise spending on the elderly absent fiscal policy reforms.”

- Mandatory spending woes: The report also highlights a projected “rise in mandatory spending on Medicare and Social Security by 1.5% of GDP,” as well as the looming insolvency of the Medicare Hospital Insurance Trust Fund by 2035 and the Social Security Trust Fund by 2033.

- Recession on the horizon: Fitch also projects that the economy will enter a “mild recession” in the fourth quarter of 2023 and the beginning of 2024.

2011 Standard & Poor’s Downgrade

Previous Downgrade: On August 5, 2011, S&P lowered its U.S. credit rating from AAA to AA+. S&P described its rationale in a Research Update announcing the downgrade:

“We lowered our long-term rating on the U.S. because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending, especially on entitlements, or on reaching an agreement on raising revenues is less likely than we previously assumed and will remain a contentious and fitful process. We also believe that the fiscal consolidation plan [the Budget Control Act of 2011] that Congress and the Administration agreed to this week falls short of the amount that we believe is necessary to stabilize the general government debt burden by the middle of the decade.”

Fact Check: Debt Downgraded Because Lawmakers and the President Failed to Adequately Address the Debt

Secretary Yellen and Democrats will try to discredit Fitch’s analysis and discount their admonitions, but they are just calling it like they see it. The debt ceiling negotiations are a window into the two parties’ position on this matter. The Democrats resisted any fiscal reforms to the debt ceiling bill, fought for status quo (a clean debt ceiling), and failed to even engage in discussions for three months creating financial uncertainty. Republicans were undeterred in their position to include fiscal reforms in the debt ceiling that would rein-in spending, return to pro-growth policies, and restore fiscal accountability.

- The Left’s Claim: A common trope from the Left and the media is that debates between Democrat presidents and Republicans in Congress over the direction of fiscal policy and the debt limit in 2023 and 2011 caused the Fitch and S&P credit downgrades.

- The Truth: In reality, the credit ratings were downgraded not because Congress debated cutting spending with the debt limit, but because the resulting spending cuts and broader reforms that the President would agree to were not significant enough to change the fiscal outlook of the country.

Fitch’s and S&P’s stated concerns related to an erosion of governance and fiscal management by the U.S. government are explicitly and directly tied to the unwillingness of lawmakers and the administration to address the underlying problems with the fiscal state of the nation.

Here is what Fitch stated in 2023:

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process.”

Here is what S&P stated in 2011:

“Our opinion is that elected officials remain wary of tackling the structural issues required to effectively address the rising U.S. public debt burden in a manner consistent with a 'AAA' rating and with 'AAA' rated sovereign peers.”

Both the current and previous Democrat Presidents have overseen the U.S. credit rating downgraded after fighting against Congressional Republican attempts to restrain deficits.

In both instances, Congressional Republicans attempted to responsibly increase the debt limit while addressing the government’s growing debt problem. In both cases, President Obama and President Biden fought against House-passed bills to increase the debt limit, issuing the strongest form of veto threats.

Consequences of High Debt and the Downgrades of the Credit Rating

According to the Congressional Budget Office, the consequences of high and rising debt include:

- “…an elevated risk of a fiscal crisis - that is, a situation in which investors lose confidence in the U.S. government’s ability to service and repay its debt, causing interest rates to increase abruptly, inflation to spiral upward, or other disruptions to occur.”

- “Borrowing costs throughout the economy would rise, reducing private investment and slowing the growth of economic output.”

- Interest payments would crowd out other budget priorities, such as national defense.

Both Fitch and S&P cite the importance of the U.S. dollar as the world’s reserve currency as a structural factor in supporting the U.S. credit rating in a positive direction. Fitch stated, “a decline in the coherence and creditability of policymaking that undermines the reserve currency status of the U.S. dollar” diminishes “the government’s financing flexibility.” CBO states that high and rising debt “could erode confidence in the U.S. dollar as the dominant international reserve currency,” due to higher expectations of inflation and a weakening value of the dollar.

Fitch’s report concludes with this ominous warning: If Congress doesn’t put forth a plan to address our deteriorating fiscal situation, we will be downgraded again. If policy makers don’t change course, we will undermine the reserve currency of the U.S. dollar—a catastrophic and potentially irreparable scenario.

How to Revive the U.S. Governments Creditworthiness

The economic consequences of unsustainable debt will affect all Americans and should not be a partisan issue. With debt this high and rising, we simply cannot absorb a future disaster or crisis. We cannot predict a war or another pandemic, but we can reduce spending and grow our economy to bring down debt. We have no choice!

In a final warning, Fitch states that if the U.S. debt profile continues to grow markedly, another credit downgrade could be on the horizon. Without changes in our fiscal policy (including on spending, interest, debt, and negative growth) we could undermine the U.S. dollar as the global reserve currency, which would result in a catastrophic, sovereign debt crisis and further worsen our credit rating.

Fitch’s rating change should be yet another signal that Congress and the President must address the underlying fiscal problem. To revive confidence in the U.S. government’s creditworthiness, lawmakers should:

- Stop the Spend. Fitch’s warning comes as the debt limit has been suspended through January 1, 2025, under the Fiscal Responsibility Act. During the most recent debt limit suspension between August 2019 and July 2021, $6.1 trillion was added to the debt. According to CBO, each ten-percentage point change in the federal government’s debt-to-GDP ratio causes a quarter point change in interest rates on the debt which raise future borrowing costs and slow down economic activity. Congress must use every opportunity to reduce the growth in government and control spending.

- Address the drivers of the debt. According to Fitch, “Cuts to non-defense discretionary spending (15 percent of the total federal spending) as agreed in the Fiscal Responsibility Act offer only a modest improvement to the medium-term fiscal outlook… Fitch does not expect any further substantive fiscal consolidation measures ahead of the November 2024 elections.”

- To address the underlying debt problem, all sides will need to come together to slow the growth of spending. CBO projects that on the current law trajectory, debt held by the public will grow from 100 percent of GDP today to 181 percent in 30 years. That debt is driven by the growth of spending, which is projected to grow from 25 percent of GDP in 2022 to 29 percent, well above the historical average of 21 percent.

- This includes controlling the growth of autopilot spending, which makes up almost 75 percent –and a growing share – of total spending. The U.S. currently spends 10 percent of tax revenues on interest payments. Due to rising debt and higher interest costs, the share of taxes spent on interest payments is projected to increase to more than 35 percent within 30 years. According to Fitch, the median interest-to-revenue ratio for a AAA government is 1 percent, while the median AA rating is 2.8 percent.

- To address the underlying debt problem, all sides will need to come together to slow the growth of spending. CBO projects that on the current law trajectory, debt held by the public will grow from 100 percent of GDP today to 181 percent in 30 years. That debt is driven by the growth of spending, which is projected to grow from 25 percent of GDP in 2022 to 29 percent, well above the historical average of 21 percent.

- Grow the Economy. Economic growth will be an essential component of reducing the debt to GDP ratio. One percent of GDP growth over ten years reduces the deficit by $3 trillion.

- Fix the broken budget process. As Fitch stated, our budget process is complicated and ineffective. A broken budget process will continue to yield bad results until we fix it.

The Bottom Line: “Republicans repeatedly warned the President and our Democrat colleagues during debt ceiling negotiations that their unbridled spending would not only weaken our economy, but jeopardize our future. President Biden and Senator Schumer had no sense of urgency and fought for status quo, which is clearly bankrupting our country. We need responsible leaders with the political courage to rein-in Washington’s spending addiction, return to policies that strengthen our economy, and reduce our national debt.”

James Madison said, “A public debt is a public curse.” It’s time for political courage to save the country and our children’s future…and REVERSE THE CURSE!”