House Budget Committee Reports Five Budget Process Reform Initiatives Favorably to the House

WASHINGTON, D.C. – Yesterday, the House Budget Committee held a markup of five bills regarding Budget Process Reform. All five bills were reported favorably out of the Committee to the House. These bills will reform the budget process and help ensure American taxpayers monies are not being wasted.

The bills marked up include:

H.R. 8341, the “Cost Estimates Improvement Act.”

Sponsors: Rep. Michael Cloud (R-TX), Rep. Ed Case (D-HI), Rep. Dan Meuser (R-PA), Rep. Jared Golden (D-ME), and Rep. Tom McClintock (R-CA).

This bill would require the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT), to the extent practicable, to include the cost of servicing the public debt in legislative cost estimates. It was reported to the House with a favorable recommendation by a vote of 17-7.

H.R. 8195, the “Strengthening Administration PAYGO Act of 2024.”

Sponsors: Rep. Jack Bergman (R-MI) and Chairman Jodey Arrington (R-TX).

This bill would provide transparency on unchecked administrative spending by ensuring the Executive Branch is held accountable when issuing costly executive actions. It was reported to the House with a favorable recommendation by a vote of 16-9.1

H.R. 8372, the “Debt Per Taxpayer Information Act.”

Sponsor: Chairman Jodey Arrington (R-TX).

Despite the fact that the nation’s fiscal trajectory impacts the lives of every American, many do not know the true extent of the federal debt or what it means for them. reported to the House with a favorable recommendation by a vote of 21-4.

H.R. 8342, the “Improper Payments Transparency Act.”

Sponsors: Rep. Rudy Yakym (R-IN), Rep. Jimmy Panetta (D-CA), Rep. Jack Bergman (R-MI), Rep. Scott Peters (D-CA).

This bill would direct the President to include in the annual budget request the amounts and rates of improper payments at each executive agency, year-over-year trends, a detailed explanation of trends, and a summary of any corrective actions taken to address improper payments. It was reported to the House with a favorable recommendation by a vote of 18-7.

H.R. 8343, the “Enhancing Improper Payment Accountability Act.”

Sponsors: Rep. Blake Moore (R-UT) and Rep. Abigail Spanberger (D-VA).

This bill would codify stringent and timely reporting requirements for new federal spending programs that dispense more than $100 million annually in their initial years of operation as well as for current programs that are required to report on improper payments but do not do so. It was reported to the House with a favorable recommendation by a vote of 18-7.

Read more below on key moments on each bill from the markup.

Congressman Burgess on H.R. 8241, Cost Estimates Improvement Act:

“It is clear that the massive cost of servicing public debt poses an enormous threat to our economy. However, the cost of servicing public debt are not included in legislative cost estimates. This omission can lead to an incomplete assessment of a bill’s financial impact, under estimating the true long term cost to the taxpayers. Congress relies on the Congressional Budget Office and the Joint Committee on Taxation to provide objective and nonpartisan cost estimates in order to understand the financial implications of the proposed legislation. The exclusion of the associated interest costs that will incur as a result of the bills implementation can lead to an incomplete assessment of the bill's financial impact.”

Congressman Bergman on H.R. 8195, Strengthening Administrative PAYGO Act of 2024:

“Despite the bipartisan Fiscal Responsibility Act of 2023 renewing Administrative PAYGO, the Biden Administration has opted to turn this measure into at best a lackluster budget exercise, some might just say they're ignoring congressional intent. So the solution, if you will, is this legislation. President Biden has failed uphold his end of the Fiscal Responsibility Act when it comes to enforcing administrative PAYGO.”

Chairman Jodey Arrington on H.R. 8372, Debt Per Taxpayer Information Act:

“I think one of our most important responsibilities is to create the sense of urgency and raise the awareness with the American people about this unsustainable debt trajectory that we're on and the consequences that could unfold. If we were to have a debt related crisis. Again, I think we're all numb to the debt clock. But if we were to have taxpayers open up their W-2 and see what their share of the debt is, and at this point, the debt per taxpayer is a little over $200,000. Just maybe we would have our fellow American citizens engage all the more, ask questions, have conversations at the watercooler at work, or at the kitchen table.”

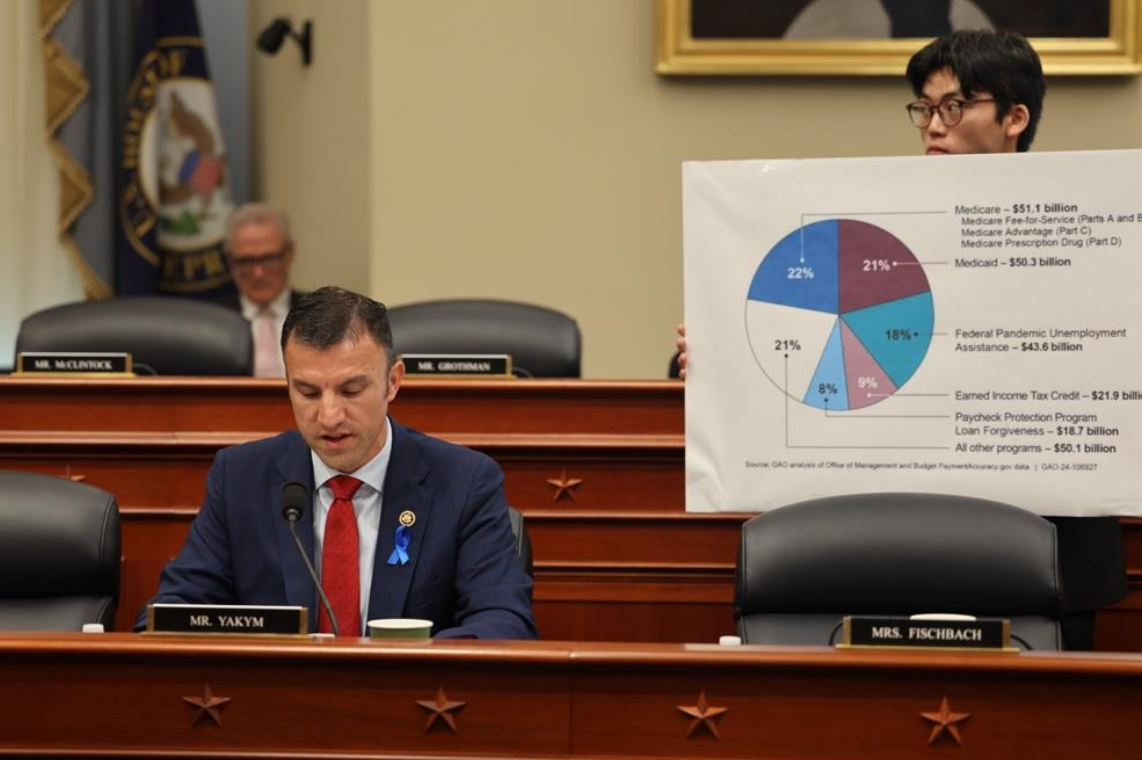

Congressman Yakym on H.R. 8342, Improper Payments Transparency Act:

“Since 2003, the federal government has made over $2.7 trillion of improper payments. According to the Government Accountability Office, in fiscal year 2023 alone, an estimated $236 billion of improper payments were made. That is completely unacceptable. Digging deeper into the GAO data 74 percent of the $236 billion of improper payments were due to overpayments. 17 percent of pandemic or federal pandemic unemployment insurance assistance payments were overpayments, upwards of 33 percent of Earned Income Tax claims are improper. I'm a businessman by background. And I can tell you that no business would survive allowing 33 percent of its payments to be overpayments. Taxpayers expect more from their government. And we as as members of Congress should too. We must never forget that every dollar collected through taxes is $1 that hardworking Americans don't get to put towards feeding their families buying a home or saving for retirement.”

Congressman Moore on H.R. 8343, Enhancing Improper Payment Accountability Act:

“As Congress has created new programs and federal spending grows, so does the risk of improper payments. Annual improper payments have increased from $106 billion in fiscal year 2013 to $247 billion in fiscal year 2022. That's a 133 percent increase. To tackle this challenge, ensuring that new federal programs in particular have guardrails and strategies in place to reduce the risk of fraud can help address these increasing rates of improper payments. At times, an agency’s internal controls for risk management don't highlight the susceptibility of new programs to significant financial waste, fraud, and abuse. A lack of permanent structural risk management practices for new federal spending programs leaves them even more vulnerable to significant improper payments to reduce wasteful fraudulent and fraudulent spending and new programs. The Enhancing Improper Payment Accountability Act would codify GAO recommendations to designate all new federal spending programs that make more than $100 million in payments annually in the first three fiscal years as susceptible to significant improper payments in their initial four years of operation.”

More from the House Budget Committee:

Read House Budget Committee Chairman Jodey Arrington’s (R-TX) opening remarks from the markup HERE.