Via Forbes: CBO: Cost of Federal Student Loans Nears $400 Billion

On Tuesday, the Congressional Budget Office (CBO) released its updated budget projections for fiscal years (FY) 2024-2034. This is an update to its February baseline.

The CBO’s analysis highlights that the cost of federal student loan programs are skyrocketing, with taxpayers projected to spend $393 billion, or $3,100 per household, on these programs over the next 10 years.

$140 billion or over a third of this cost directly stems from President Biden’s student loan forgiveness schemes.

A recent Forbes editorial breaks down CBO’s latest student loan projection:

Word on the Street:

Via Forbes:

• “Taxpayers will spend $393 billion on the federal student loan program between 2024 and 2034, or around $3,100 per household.”

o Around $221 billion of that cost comes from expected losses on the $1.1 trillion in student loans that the federal government will issue between 2024 and 2034.”

o “The remaining $140 billion is down to re-estimates of the losses that taxpayers will bear on outstanding loans, thanks to President Biden’s efforts to expand student loan cancellation programs using executiveauthority. ”

• “For comparison, over the same time period [2024 to 2034] CBO expects the federal government will spend $355 billion on the Pell Grant program, which provides free college aid to low- and middle-income students.”

• “Taxpayers have ended up in an odd situation, where they spend more making student loans (which are supposed to be repaid) than making grants (which are not).”

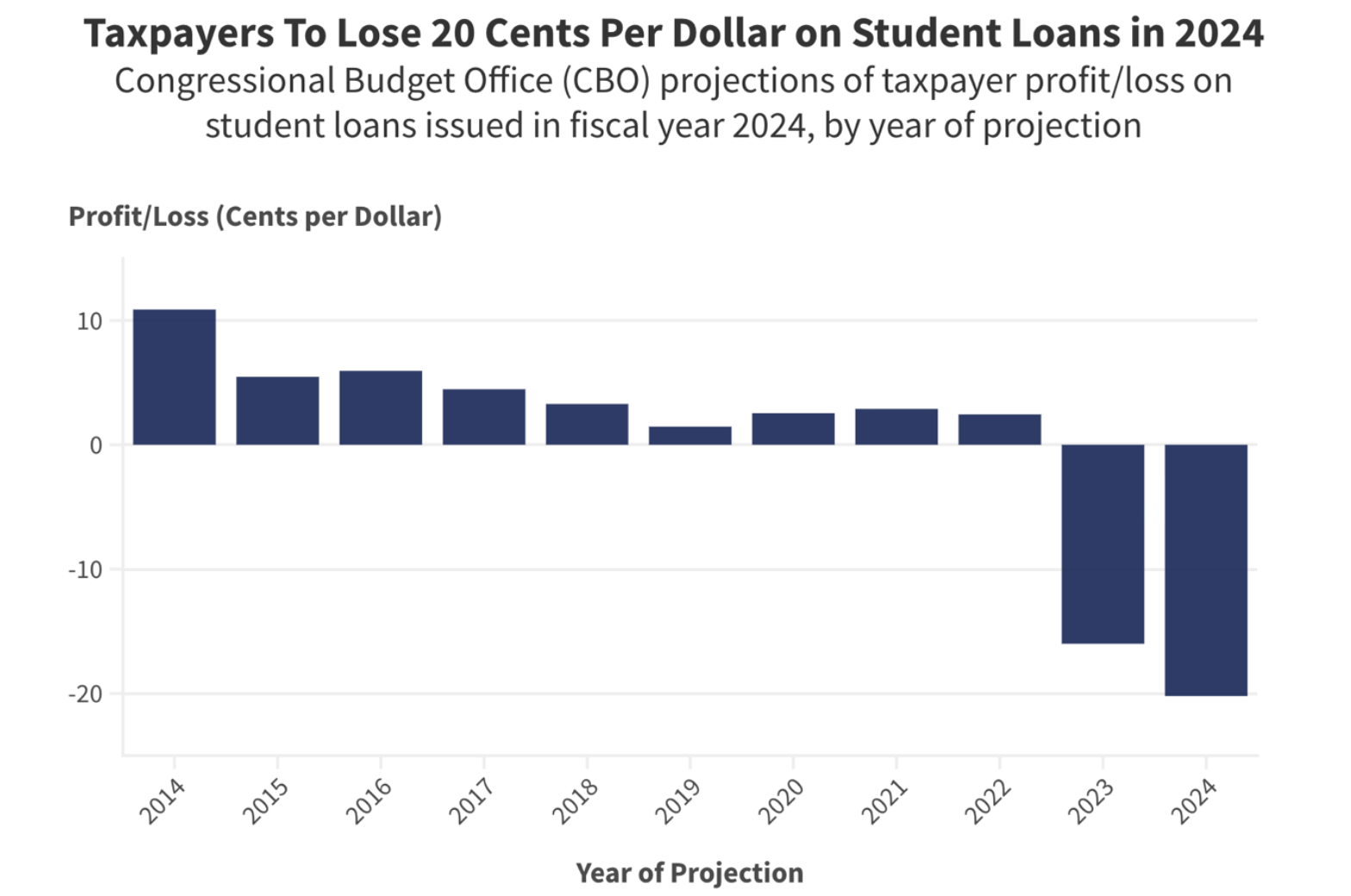

• “The costs of running the student loan program have exploded in recent years, as past CBO projections show. In 2014, the agency projected that taxpayers would profit to the tune of 11 cents for every dollar of student loans the federal government issued in fiscal year 2024. But the most recent projections figure instead that taxpayers will lose 20 cents on the dollar for loans issued this fiscal year. ”

• "The dynamic impact of increased borrowing, not to mention additional loan-cancellation initiatives from the Biden administration, could drive government losses on student loans even higher over the coming years. Taxpayers should buckle up for a bumpy ride.”

The Bottom Line:

America’s balance sheet is already feeling the impact of the Biden Administration’s unilateral plans to cancel student debt.

Most recently, CBO’s FY24 deficit projection increased by $408 billion or 27 percent compared to February 2024. The largest driver of this increase was a “$145 billion increase in outlays for student loans” due to “revisions that the Administration made to the estimated subsidy costs of previously issued loans and from the Administration’s proposed rule to reduce many borrowers’ balances on student loans.”

The House Budget Committee’s (FY)25 Budget eliminates President Biden’s student loan cancellation schemes, protecting current and future taxpayer dollars in the process.

More From the House Budget Committee:

Read House Budget Committee Chairman Jodey Arrington’s (R-TX) statement on CBO’s updated baseline projections over the next decade HERE.

Read an executive summary of CBO’s updated baseline projections HERE.

Read comparisons of CBO’s February 2024 baseline report and the June 2024 update, and a comparison of the baseline when President Biden took office to today HERE.

Read how much President Biden’s student loan scheme could cost taxpayers HERE.