Winston Group Survey Says: Inflation Fears Flare Again

The worse-than-expected economic indicators for the first quarter of 2024 sent shockwaves through the economy and for consumers, shattering widespread hope for an imminent cut to interest rates, previously teased by Federal Reserve Chair, Jerome Powell.

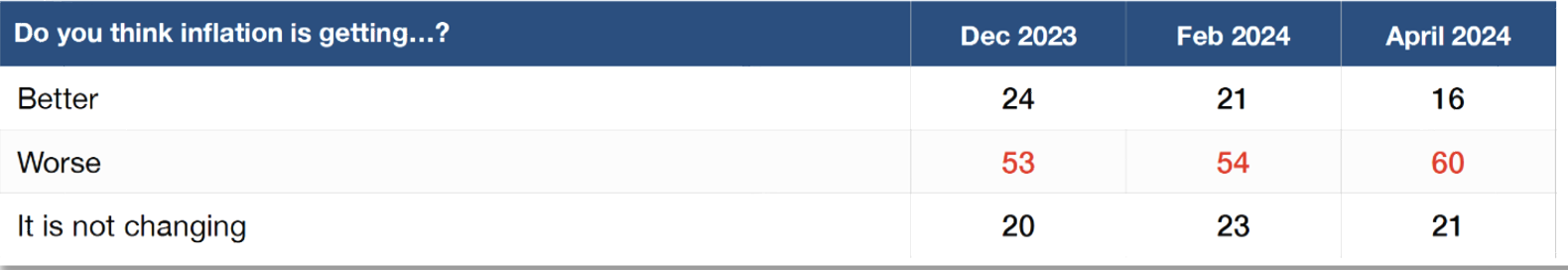

The Winston Group (WG), a strategic planning and survey research firm, issued their findings from a survey that revealed “60% of respondents now believe inflation is worsening,” a sharp increase from just a few months ago.

Here is what Chairman Arrington said yesterday in response to the Federal Open Market Committee(FOMC) — the Federal Reserve’s (Fed) committee of key decision-makers — announcement that there will be no change to interest rates in the near future:

“Democrats and President Biden have made history for all the wrong reasons: record $7 trillion in additional debt, a record number of regulations by a President, and 40-year high inflation. It’s no wonder GDP growth is stalling, consumer confidence is faltering, and the Federal Reserve won’t be dropping interest rates anytime soon, which will only perpetuate the cost-of-living crisis and put the American Dream of home ownership farther out of reach for hardworking families than ever before.”

Word on the Street:

Via WG:

- “With six months to go until the election, the White House has been eager to change voters’ minds about inflation improving thanks to the President’s policies, but our numbers show their views moving in the opposite direction.”

- “From our new survey for Winning the Issues (April 27-29), there has been an increase in the percentage saying inflation is getting worse – now at 60% - rather than better (16%) or not changing (21%).”

- “The last inflation reports have shown inflation remaining at or above 3% for ten months in a row. With the unexpected uptick in PCE, this has now caused a re-examination of the inflation situation as potentially rebounding.”

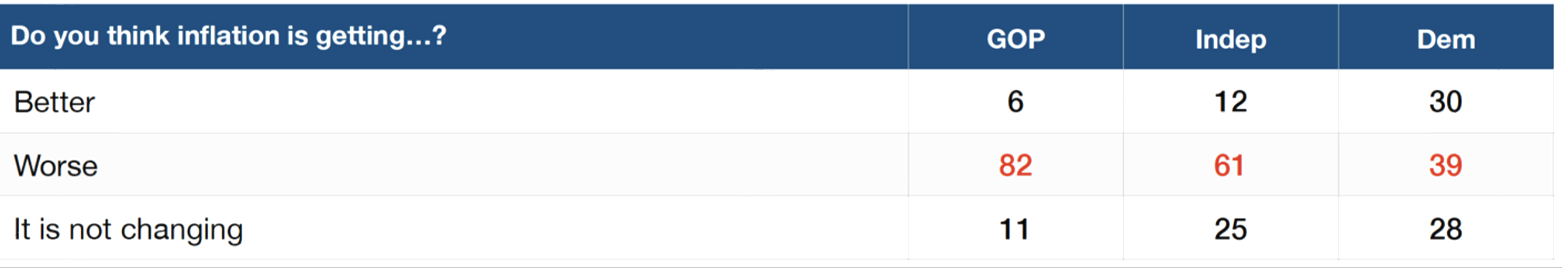

- “Our numbers show that Republicans (82% worse) and independents (61%) are overwhelmingly of the view that inflation is getting worse, but with even a plurality of Democrats (39%) seeing inflation as getting worse instead of better (30%)”

The Bottom Line:

Americans deserve an economy they can depend on.

The Winston Group’s findings follow a series of worse-than-expected economic outlooks for the first quarter (Q1) of 2024. Persistent inflation, and the costly consequence of stubbornly high interest rates, confirms that the U.S. economy will remain top of mind for the U.S. taxpayer for the foreseeable future.

The multi-year economic fall-out from President Biden's and Congressional Democrats' poorly implemented fiscal policies has yielded the harsh, but expected, reality that inflation is still increasing – spiking to 3.5% in March 2024, the highest level in six months – and resulted in federal funds rate stubbornly remaining between 5.25%-5.50% since July 2023, the highest level in more than two decades.

Despite fervent efforts by the Biden Administration to explain away the economic outlook in their favor, WG’s findings capture a shifting tide of public opinion, showing voters increasingly skeptical of the Biden Administration's ability to curb inflation.

More From the House Budget Committee on the Economy:

- Read Chairman Arrington’s statement on the March inflation rate coming in at 3.5 percent HERE.

- Read Chairman Arrington’s statement on GDP rising by 1.6 percent for Q1 of 2024 HERE.

- Read Chairman Arrington’s statement on April’s Consumer Confidence falling to the lowest level since July 2022 HERE.

- Read Chairman Arrington’s statement on the FOMC meeting HERE.