ICYMI: The Problem with Bidenomics

Consumer costs continue to rise every month, and as a result, prices remain over 17% higher than when President Biden took office. Despite the White House’s promises that price hikes will fall, that isn’t how inflation works—price increases fueled by President Biden’s reckless spending are stubbornly baked-in and not going away.

Larry Lindsey, former Director of the National Economic Council at the White House under President George W. Bush highlights how inflation driven prices, in addition to elevated interest rates, are robbing American prosperity and producing a frustrated, negative national mood.

Word on the Street Via The Lindsey Group:

- “Some puzzle over why Americans are so downbeat on economy. For example, Celinda Lake, a pollster for Democratic politicians, noted that ‘things are getting better, and people think things are going to get worse—and that’s the most dangerous piece of this.’”

- “In truth, the dissatisfaction is not irrational. Real average hourly earnings are down 2.5 percent since Election Day 2020 and real median usual weekly earnings are down 3.2 percent. That latter compares with an 8.0 percent gain over the previous four years.”

- “But this ignores the fact that sentiment might be different from cash flow. Consider housing. […] Today it takes nearly 60 percent of a median family’s income to cover a mortgage on a median-priced home. The standard historically has been around 30 percent…”

- “The loss of choice has an impact on economic wellbeing that reaches well beyond that of price. Those same unhappy car drivers know that their options are going to become even more limited as mandates for electric vehicle sales begin to bite. […] The same can be said of people who like cooking on a gas range but will only be able to buy an electric one.”

- “The bad news for President Biden is that restrictions on consumer choice have become a hallmark of his Administration, and these bear a cost in terms of economic wellbeing that are not captured by wage and price data […] factor in issues of economic wellbeing not captured by the statistics and voters’ unhappiness becomes rampant.

The Big Picture:

Since President Biden took office, the price of consumer goods has increased by 17.2 percent. This amounts to $1,268 in additional costs per monthfor a family of four. That isn’t going to change for the better any time soon—it is more likely that the cost of living in America will continue to rise.

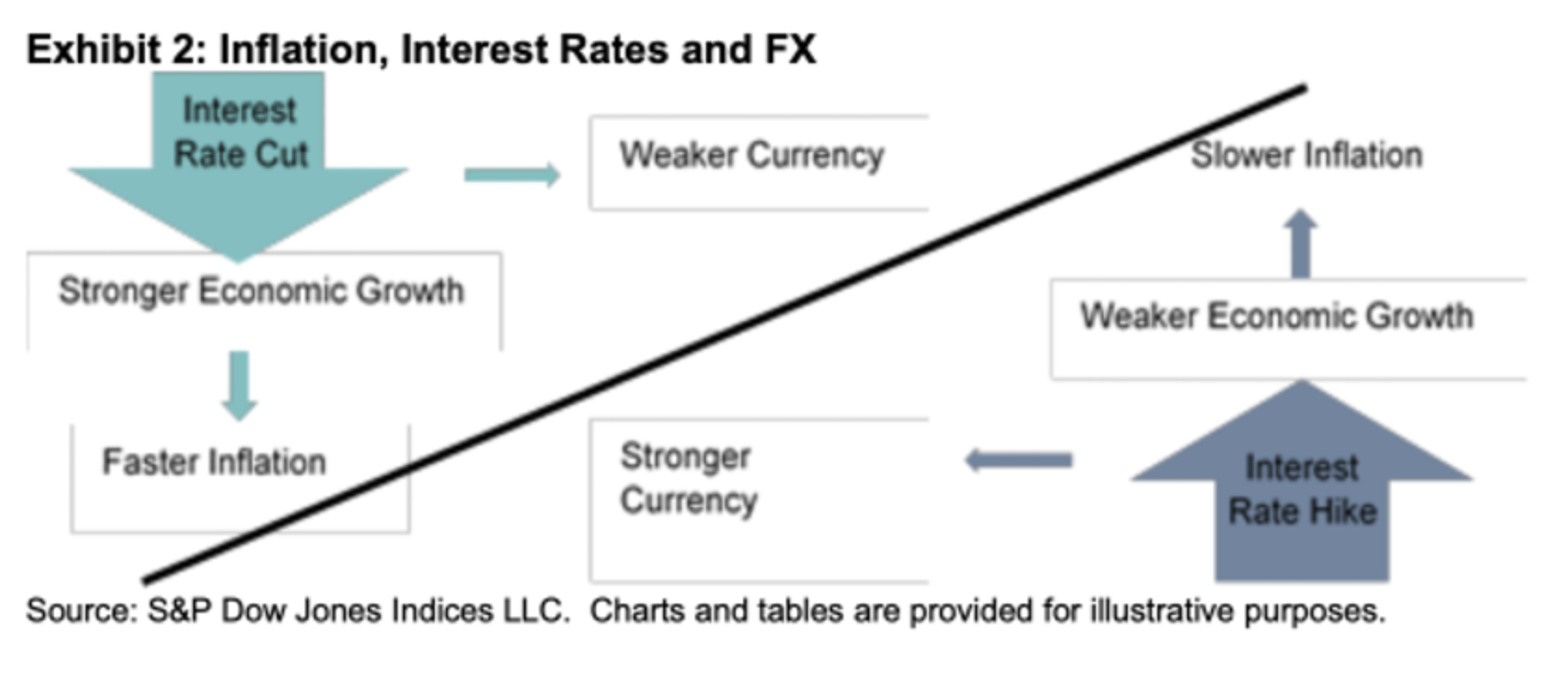

Not only are prices up and continuing to rise, but elevated interest rates have made higher prices even harder to swallow. Monthly mortgage paymentsfor the average American house are double what they were when President Biden took office. Car-buyers, businesses, and credit-card users have also been impacted.

This double-whammy of higher prices and higher interest rates are wreaking havoc on consumers and their assessments of the economy.

The Bottom Line:

‘Bidenomics’ isn’t working for the American people. Blowout spending that exacerbated inflation, elevated interest rates, and growing restrictions on consumers’ choice is devastating Americans’ confidence in the economy and contributing to our nation’s bleak economic outlook. Contrary to what President Biden thinks, higher prices are here to stay.

To reverse the curse of Democrats’ tax and spend agenda, Washington needs new leadership with a pro-growth philosophy to change our broken budget process and restore fiscal sanity to Congress.

House Budget Republicans have a plan to get the American economy back on track.

Three years later and ‘Bidenomics’ still isn’t working for America.

Democrat’s mass influx of partisan spending included the so-called American Rescue Plan of 2021 paved the way for a multi-year financial devastation not experienced by U.S. taxpayers in more than 40 years—a period of persistent economic distress that continues to plague both Main Street and Wall Street in present day:

Democrats ill-informed, wasteful legislation inflated the market and forced the Federal Reserve to steadily increase interest rates over a period of two years. They used the full power of the federal government to enact special interest tax breaks while leaving the financial well-being taxpayer to fall to the wayside.

Even now, families are still unable to shoulder the costs of critically essential goods and services. The typical American household are now forced to spend an additional $11,434 annually just to maintain the same standard of living they enjoyed in January of 2021, right before inflation soared.

As Washington prepares for the second half of the 118th Congress, House Budget Committee Republicans will continue to fight for a pro-growth, smart-spending philosophy that will restore fiscal sanity to Congress and reverse the ongoing curse of Democrats’ tax and spend agenda.